Z. Christopher Mercer

Book Description

Buy-sell agreements are among the most common yet least understood business agreements and many are destined to fail to operate like the owners expect. Many, in fact, are ticking time bombs, just waiting for a trigger event to explode. If you are a business owner or are an adviser to business owners, this book is designed for you, providing a road map for business owners to develop or improve their buy-sell agreement.

About the Author

Chris Mercer is the founder and chief executive officer of Mercer Capital.

Chris began his valuation career in the late 1970s. He has prepared, overseen, or contributed to hundreds of valuations for purposes related to tax, ESOPs, buy-sell agreements, and litigation, among others. In addition, he has served on the boards of directors of several private companies and one public company. He enjoys working with business owners to address ownership transition issues.

Chris has extensive experience in litigation engagements including statutory fair value cases, divorce, and numerous other matters where valuation issues are in question. He is also an expert in buy-sell agreement disputes.

Chris is a prolific author on valuation-related topics and a frequent speaker on business valuation issues for national professional associations and other business and professional groups.|Chris Mercer is the founder and chief executive officer of Mercer Capital.

Chris began his valuation career in the late 1970s. He has prepared, overseen, or contributed to hundreds of valuations for purposes related to tax, ESOPs, buy-sell agreements, and litigation, among others. In addition, he has served on the boards of directors of several private companies and one public company. He enjoys working with business owners to address ownership transition issues.

Chris has extensive experience in litigation engagements including statutory fair value cases, divorce, and numerous other matters where valuation issues are in question. He is also an expert in buy-sell agreement disputes.

Chris is a prolific author on valuation-related topics and a frequent speaker on business valuation issues for national professional associations and other business and professional groups.|Chris Mercer is the founder and chief executive officer of Mercer Capital.

Chris began his valuation career in the late 1970s. He has prepared, overseen, or contributed to hundreds of valuations for purposes related to tax, ESOPs, buy-sell agreements, and litigation, among others. In addition, he has served on the boards of directors of several private companies and one public company. He enjoys working with business owners to address ownership transition issues.

Chris has extensive experience in litigation engagements including statutory fair value cases, divorce, and numerous other matters where valuation issues are in question. He is also an expert in buy-sell agreement disputes.

Chris is a prolific author on valuation-related topics and a frequent speaker on business valuation issues for national professional associations and other business and professional groups.|Chris Mercer is the founder and chief executive officer of Mercer Capital.

Chris began his valuation career in the late 1970s. He has prepared, overseen, or contributed to hundreds of valuations for purposes related to tax, ESOPs, buy-sell agreements, and litigation, among others. In addition, he has served on the boards of directors of several private companies and one public company. He enjoys working with business owners to address ownership transition issues.

Chris has extensive experience in litigation engagements including statutory fair value cases, divorce, and numerous other matters where valuation issues are in question. He is also an expert in buy-sell agreement disputes.

Chris is a prolific author on valuation-related topics and a frequent speaker on business valuation issues for national professional associations and other business and professional groups.|Chris Mercer is the founder and chief executive officer of Mercer Capital.

Chris began his valuation career in the late 1970s. He has prepared, overseen, or contributed to hundreds of valuations for purposes related to tax, ESOPs, buy-sell agreements, and litigation, among others. In addition, he has served on the boards of directors of several private companies and one public company. He enjoys working with business owners to address ownership transition issues.

Chris has extensive experience in litigation engagements including statutory fair value cases, divorce, and numerous other matters where valuation issues are in question. He is also an expert in buy-sell agreement disputes.

Chris is a prolific author on valuation-related topics and a frequent speaker on business valuation issues for national professional associations and other business and professional groups.

Recent Books

Talbot Stark

Are you ready to take control of your career, life, and destiny by becoming an elite performer? This isn’t just ...

Larry Mandelberg

How Healthy Is Your Successful Business? Do constant disruptions and distractions make you feel like the business is managing you ...

Robert Pizzini

This book is born of my desire to share with others the simple yet effective practices which have given me ...

Lori Darley

Lori Darley has dedicated her life to embodying the fullest and most authentic expression of the human experience, both through ...

Brady Brim-DeForest

Small is the next big thing. When working for a large organization, weeks can pass before leadership makes important decisions that ...

Dr. Kourosh Maddahi

Award-winning cosmetic dentist and best-selling author, Dr. Kourosh Maddahi, reveals the results of over three decades of research into our ...

Shawn Casemore

You're in big trouble if you rely on having "feet on the street" to generate new sales. Selling in today's ...

Chris Heller

Your thoughts determine your results! Chris Heller, a nationally recognized leader in real estate, joins bestselling author Greg Reid to ...

Deanna Singh

Are you tired of hollow promises about diversity, equity, and inclusion in your organization? Do you want to take steps ...

K P Weaver

Book 2 of The Alchemy of Life Magic Collection Do you know how to know? In The Power of Knowing ...

Scott Miller

In the ever-evolving world of content creation, social media, videos, TV and radio shows, podcasts, vlogs and blogs, and search ...

Jeremy Boerger

Most IT directors and ITAM (Information Technology Asset Management) team leads learn on the job. ITAM is specialized enough that ...

Scott Conant

Peace, Love, and Pasta, Scott Conant’s most personal and accessible cookbook to date, delves into the evolution of how his ...

Bill Humbert

"You get what you expect in life. It's true scientifically and theologically. Bill Humbert now shares irresistibly compelling insights on ...

Deepak Chopra

An enlightening guide to success, fulfillment, wholeness, and plenty, offering practical advice on how to cultivate a sense of abundance in ...

Michaela Weaver

The Alcohol Con is the empowering and positive solution for problem drinking from Michaela Weaver, founder of The Alcohol Coach. ...

Terre Short

Speak your truth. Maximize the power of your voice and deepen your connection with loved ones, colleagues, customers, and those ...

Andy Miller

The first book written on hiring salespeople based upon 85 years of organizational psychology research, data analytics on 2.1 ...

Elijah J. Stacy

Elijah Stacy suffers from Duchenne muscular dystrophy, a fatal muscle wasting disease. At the age of sixteen, to avoid agonizing ...

Donna Cutting

"You provide a red-carpet treatment for your employees and they’ll reward you with their effort, time, and loyalty."- Jeffrey ...

Chris Westfall

You know the drill: the business of life can be tough. Deadlines. Relationships. Expectations. And conflict. Challenges are everywhere. ...

Maurits van Sambeek

Omnibenevolence Secrets Every Philanthropy Director Needs To Know! (and Why You Should Read This Book Even If You’re Not A ...

Peter Margaritis

Going OFF SCRIPT doesn’t come naturally to most organizational leaders. We want to control the narrative, ensure ideal outcomes, script ...

Steve Lishansky

The journey of leadership is one of the most significant endeavors of humanity. Leadership is important for us to ...

Tom Fox

The “Nuts and Bolts” for Creating a Comprehensive Compliance Plan The first chapter of this unique work lays out a ...

David Black

This is what it is like to suffer due to doctor mistakes and their refusal to admit the mistakes. It ...

Barry Jessurun

The Drunkard's Path is self-help and career guide based on four decades of working in the hospitality industry. It offers ...

Carol J. Kaemmerer

Many first impressions are made on LinkedIn, so every business professional must convey his or her personal brand effectively on ...

Captain Emil Dobrovolschi & Octavian Pantiș

"This is your captain speaking." Become a better pilot for your projects, for your people, and even in life outside ...

Jon Petz

Life is about moments . . . The Simple Moments that can be the most significant. A chance meeting. An ...

Ron Karr

Everyone knows what qualities define a good leader, but how many of us know what steps to take to become ...

Dee Bowden

The Sale is not Complete until the Money is in the Bank...but you must collect it first. Collections are uncomfortable ...

Shawn Nason

One of the Most Important and Surprising Business Books of the Year And it might just also change your life! ...

Mitzi Perdue

As the organizer of the Global Anti-Trafficking Auction, Mitzi Perdue often gives talks on human trafficking. After these talks, people ...

Jon Petz

In Person and Hybrid Meetings, the cornerstones of collaboration, inspiration, and progress have suffered excruciating humiliation at the hands of ...

Dave Ferguson

Employees rarely go to work to follow anyone for more than money. They certainly aren’t there to follow the vision ...

Randy Gage

You can't have lasting, meaningful happiness unless you're willing to continually reinvent yourself. That reinvention must always start with challenging ...

Gregg Greenberg

F*cking Argentina and 10 More Tales of Exasperation is an intelligent and witty series of short stories that feel like ...

Guy Snodgrass

Learn how to be a leader in your own life and career with expert advice from one of the Navy's ...

John Lee Dumas

Say hello to YOUR version of uncommon success with a revolutionary 17-step roadmap to guide your journey to financial, location, ...

Dr. Shellie Hipsky

Dr. Shellie’s Ball Gowns to Yoga Pants helps you start building your authentic brand and successful company! Dr. Shellie Hipsky’s ...

Ben McCarty

Cyberjutsu is a revolutionary approach to information security based on authentic, formerly classified Ninja scrolls. It synthesizes today's infosec field ...

Leo Bottary

Peer-no-va-tion (pir-n-v-shn) combines the words peer (people like me) and innovation (creativity realized). It's teamwork of the highest order. Leo ...

Kevin Harrington

Kevin Harrington, one of the original "sharks" of the TV hit Shark Tank, and serial entrepreneur Mark Timm take you ...

Jeff Brandeis

No matter what you sell, this fully-illustrated, easy-to-read handbook breaks through the clutter of other sales “techniques” to help you ...

C. Lee Smith

In sales, there's a lot of talk about qualifying the buyer. What's the lead scoring say? Are they a marketing-qualified ...

Dawn S. Kirk

People Are the Heartbeat of Business! The heart is the life force within each of us. It's the organ that ...

Kelly Fuhlman

Have you ever wished a superhero would come down and rescue you in those chaotic life moments of life? The ...

Stedman Graham

Become a passionate, purposeful, and meaningful leader through identifying who you are, your strengths, and your skills. New York Times ...

Mark Victor and Crystal Dwyer Hansen

Your dreams become your destiny when you learn the secret art of asking! Most people have beautiful dreams deep inside—the ...

Bill Humbert

Employee 5.0: Secrets of a Successful Job Search In The New World Order is Bill’s second book. Over 40 years ...

Shellye Archambeau

Full of empowering wisdom from one of Silicon Valley's first female African American CEOs, this inspiring leadership book offers a ...

Troy Korsgaden

In the business world, an inflection point happens at a critical moment when the situation calls for new thinking and ...

Rob Hartnett

As a companion to the game changing book It’s All Possible – how to lead an epic life by Rob ...

Mark Victor Hansen

THE BEST BOOK OF ALL TIME HASN’T YET BEEN WRITTEN, SO YOU HAVE TO WRITE IT! Mark Victor Hansen, co-creator ...

Jeff Brandeis

There are many books available to teach you techniques for closing a sale (meaning bringing a new client on board ...

Christoph Trappe

Listed as a No. 1 new public relations book in early 2020 with copies sold in Africa, Asia, Europe, North ...

David A. Paterson

"I have had this desire my whole life to prove people wrong, to show them I could do things they ...

Michael Haynes

Written for SMEs and start-ups, this book covers essential B2B topics including: Understanding what business buyers (i.e. decision-makers) really want ...

Rob Hartnett

THE ART OF THE POSSIBLE IN BUSINESS AND LIFE Positive Attitude And Willingness To Take Action Are Key In a ...

Darrell Amy

Would you like to grow revenue faster? Revenue Growth Engine presents a strategy and a model to accelerate growth. Whether ...

Jason S Bradshaw

Of all the things that can make or break your business, the most critical is experience. Great experiences inspire customers ...

Keith Ferrazzi

As the founder and CEO of Ferrazzi Greenlight, Keith Ferrazzi has spent over twenty years working with major global organizations ...

Lisa Levy

For companies who’ve embraced new opportunities only to lose money through inefficiency, mismanagement and misinformed decision-making, Lisa Levy knows there ...

Seth Earley

“We know how we want our companies to work. Enterprises ought to be customer-focused, responsive, and digital. They should deliver ...

Michael Houlihan & Bonnie Harvey

Full Cast Performance From the New York Times bestseller, The Barefoot Spirit, Comes a NEW style of Business Audiobook: Learn Valuable Lessons While ...

Marcus Anthony Ray

At age 21, following Canada's economic downturn, Marcus Ray entered the world of male exotic dancing. He was a stripper. ...

Entrepreneur Secrets to a Grow Get Give Life

Wouldn’t you love to have a road map to success in business and life? What if the steps that the ...

Belinda Goodrich

Leveraging neuropsychology, behavioral science, and Neuro-Linguistic Programming, Author Belinda Goodrich, a leading productivity expert, has effectively defined why many people ...

Brian Tait

New Mindset; New Results Accomplish Greater! The accomplishments of tomorrow should never be celebrated today. The time has come to ...

Bob Collins

Peter Drucker once said "Business Culture Eats Strategy for Breakfast". Collins asserts that a high-performance workforce, highly charged, thirsty for ...

John Lopez, PhD

Businesses operate in an increasingly diverse, global workforce, and in the coming years in the U.S., net international migration is ...

Veera B Budhi

The book is about the transformation journey every individual has to take if they want to improve their life for ...

Mallika Chopra

Featuring full-color illustrations, Just Feel is an engaging and easy-to-read guide that introduces kids to the building blocks of resilience ...

Deepak Chopra MD, FACP

In DC Comics' DC Universe, a metahuman is a human with superpowers. However, for bestselling author Deepak Chopra, to be metahuman isn’t science fiction and is certainly ...

Robin ML Johnson, DSL

Leadership loneliness is a phenomenon felt by many leaders both in the boardroom and on the front line, and while ...

Jill Griffin

What if you could gather the smartest people you know into one room and ask them anything? Who would be ...

Rachel Headley

Called "brutally honest, incredibly practical, and refreshingly hopeful," Headley and Manke shake traditional corporate culture to the core in this ...

Makarand Utpat

The world has quickly moved into the digital sphere. Disrupt or Die is the new mantra. Digital realm is engulfing ...

Tabitha Laser

The definition of insanity is doing the same thing over & over and expecting different results. We have fallen into ...

Larry Vaughn

Larry Vaughn owned and operated a successful print company – Ideal Printers - for 26 years and helped found two ...

Andrew Tarvin

If you want to increase team productivity, relieve stress, and be happier at work, you could hire a bunch of ...

Todd Wilms

Most startups fail, even the ones with great products. Even great products need a smart strategy to reach their market. ...

Betsy Atkins

Betsy Atkins is often asked “How can I get on a board?” So after 20+ years in the boardroom and ...

Galen Bingham

Does your leadership matter? Will you be remembered? Do you have IMPACT? IMPACT: A Leadership Fable is an inspirational tale ...

Dwight Holcomb

The goal of every marketer is more sales. But achieving this on a consistent basis is tougher than ever in ...

Nina Sunday

Practical insights on workplace know-how...proven tactics and hacks for better relationships, communication and effectiveness at work. Being average at your ...

Steve Rigby

A Joyous Journey to Sales Success In a world full of quick fixes and hyper-aggressive focus on systematized sales, S.M.I.L.E. ...

Eddie Turner

Leadership is one of the world's oldest professions. There are countless resources for one to learn about leadership and do ...

Jeffrey Hayzlett

There are leaders. Then there are HERO leaders—those who go beyond providing free coffee in the office or giving 10 ...

Byron Reese

“The Fourth Age not only discusses what the rise of A.I. will mean for us, it also forces readers to ...

Dr. Diane Hamilton

Cracking the Curiosity Code: The Key to Unlocking Human Potential: Curiosity is one of the most analyzed, discussed, and written ...

Anthony Iannarino

The first ever playbook for B2B salespeople on how to win clients and customers who are already being serviced by ...

Dr. Evans Baiya & Ron Price

Innovation is not just about technical and systematic processes. In The Innovator's Advantage, authors Evans Baiya and Ron Price reveal that ...

Mark LeBusque

Being Human challenges the notion that technical competence and a Robotic approach to Human Management still has a place in ...

Theresa Rose

Mindful Performance is an easy-to-digest how-to book that blends mindfulness and mental mastery techniques with proven high-performance business strategies you ...

Peter Loge

Soccer is 90 minutes of systems thinking in action. Soccer Thinking for Management Success is by a soccer fan and ...

Allison Shapira

Your voice matters, especially as a leader. Every day, you have an opportunity to use your voice to have a ...

Mark Hunter

“High-Profit Prospecting” digs deep into the specific techniques sales leaders use to keep their pipeline full of the RIGHT prospects. ...

Ron Price & Stacy Ennis

Emily is a career-driven thirtysomething with big ambitions and a young family. She is making an impact as a manager ...

Karyn Schoenbart

CAREER ADVICE FROM A GLOBAL CEO WHO JUST HAPPENS TO BE A MOM In Her New Book Mom.B.A., CEO Karyn ...

Daniel Burrus

Discover 25 proven strategies any size organization or individual can use to accelerate innovation and growth with the low risk ...

Chris Westfall

Complacency is the enemy of every leader. If you have a vision—for yourself, your team and your organization—you owe it ...

David Parish

The environmental policy landscape can be tough to navigate between politicians, advocacy groups and businesses having a different message. Alaskan ...

Leo Bottary

Most of us don’t seek advice or reach out to others for help very easily. In part, it’s because we’re ...

Ralph Ward

For the Board Seeker... This is the first practical guide written specifically to help board-ready leaders and executives gain the ...

Julie Cottineau

Julie Cottineau is the Author of the Best-selling book “TWIST: How Fresh Perspectives Build Breakthrough Brands” (Panoma Press, 2016). She ...

Mark Samuel

In business and life, there are often moments when one simply can't seem to find a way forward. Searching in ...

Mike Pierce

Learning to Lead is critical for success into today's world. No matter what our title is, pay level, industry or ...

Sheila Anderson

Sheila A. Anderson is a master at bringing forward the inner and outer expression and connecting it with the experience ...

David Avrin

The landscape is littered with the corpses of great products and strong companies that died because of crappy marketing. Why ...

Cathy Dolan-Schweitzer

Do your healthcare projects feel overwhelming and stressful at times? Do you have difficulty collaborating with healthcare system professionals? Do ...

Nancy Lynn

To be young, polished and professional is not simply wearing the right clothes and saying the right words. Polished encompasses ...

Kathleen Thomas

Financial Advisor Kathleen Thomas has seen the difficulties and setbacks that occur when women don’t own their financial lives. It’s ...

Neen James

Drive profitability, productivity, and accountability To create extraordinary lives, we must learn to “unplug” from the constant barrage of disruptions ...

Mark Eaton

Why do some organizations regularly outperform their competition? What’s the key to creating a united team that’s an unstoppable force ...

James Kelley

In an era of unauthentic leaders, the stakes could not be higher for embracing a better version of yourself that ...

Tanya Hall

Are you considering writing a book to boost your visibility and credibility? Or just trying to figure out how to ...

Dale J. Dwyer, Ph.D.

Everybody knows someone who is over-controlling or who needs a great deal of approval. Or it may be that you ...

Beverly D. Flaxington

If you're an entrepreneur, if you own a business, or if you plan to start one-you're a salesperson, whether you ...

Gloria Petersen

Gloria Petersen’s “Success Strategies for Networking in Person and Online,” offers five paths to create your person-to-person and online networks ...

David J.P. Fisher

"If you could cross the late, great, sales coach Zig Ziglar – a master of face-to-face relationship selling and networking ...

Karima Mariama-Arthur

This book is an exceptional resource for leaders at every level across industries. An insightful guidebook comprised of 40 illuminating ...

David L. Brown

From the Bottom Up: The Ultimate Guide for Business Planning to Profitability is a step-by-step guide for writing a business ...

David Oualaalou

As the debate surrounding Iran’s nuclear agreement with the West becomes increasingly contentious, US allies in the deal: UK, Russia, ...

Jack Myers

In Jack Myers prescient book, TheFuture of Men: Men on Trial, he predicted the current wave of exposure of male ...

Andrew Bryant

Get greater control of your life and career with this easy to read, and yet profound handbook. Explore your Self-awareness, ...

Frumi Rachel Barr

Prevent the grinding sands of conflict from seizing the gears of business decision-making. A CEO’s Secret Weapon offers 10 results-oriented ...

Stephen Monaco

If you are looking for a book authored by someone who has been there as an employee, a successful entrepreneur ...

Andrew Horsfield

Work worth doing always has a hard part. In any results-driven activity, there are defining moments. That point in time ...

Evan Sanchez

Lack of sales results and performance gaps are typically addressed with more skills training, more product or service knowledge, and ...

Stu Heinecke

Sales and marketing teams are told to fill the funnel, increase revenues, and move the needle on market share—then left ...

Dr. Terri Levine

This book is a guide to doing business with heart and being authentic and transparent with employees, vendors, prospects, and ...

Deirdre Breakenridge

Answers for Modern Communicators, A Guide to Effective Business Communication, provides professionals with practical answers to important career and communication ...

Lois Creamer

This book is the definitive guide on the business of speaking. You'll find everything you need to know to jump ...

Christian Kromme

Imagine being able to spot the next big trend, or being able to predict the next big wave of change. ...

Brian Hazelgren

Healthy Habits of Highly Productive Employees is a breakthrough book of successful tips, stories, and systems to formulate the best ...

Doug Andrew

Entitlement Abolition, from New York Times bestselling author Douglas R. Andrew, underscores the focus on all three dimensions of abundance ...

Mareen Thomas Cherian

Managing Modern Brands: Cult Theory and Psychology is a succinct work that explores the emotional connect that brand managers crave ...

Joanne Sonenshine

On a career path that one could only call circuitous, Joanne Sonenshine learned that what fulfilled her the most was, ...

Robin Speculand

At a time of tremendous business disruption, leaders need to execute strategies more frequently and more effectively than before. Excellence ...

Joel G. Block

This is a special book with a special agenda that I reveal in just a moment. But before I do ...

Jamie Crosbie

At Last, a book for sales managers built on real world sales experience. This book offers a fresh, up to ...

Darren Taylor & Mark Schreiber

The emergence of digital technologies has democratized branding from the province of marketing professionals to any teenager with an Instagram ...

Kristiane Cates

K. Cates and her husband, Chad, were an ordinary couple who attended church, enjoyed barbeques with friends on the weekends, ...

Richard Marker

This collection of essays is both timely and timeless. They cut through the clutter of popular jargon and fads in ...

Phil M. Jones

Often the decision between a customer choosing you over someone like you is your ability to know exactly what to ...

Frans de Groot

This book is about the World's First Business Management Model that Guarantees achievement of goals: The BITSING methodology. This scientifically ...

Jill Griffin

My new book is about women who have beaten the odds. Early on, they heard the whispers....the inner-call to leadership. ...

Tony Chatman

Leadership is all about leading people. if you can't effectively lead people, you can't be considered an effective leader. The ...

Jim Donovan

Even in a tight economy, job satisfaction isn’t a luxury; fulfilled, happy employees are productive, innovative, and loyal. And workplace ...

William E. Schneider

"Lead Right For Your Company's Type: How to Connect Your Culture With Your Customer Promise" shows how every organization falls ...

Colin Price

Accelerating Performance is not just another “warm and fuzzy” change management book—it's a practical, comprehensive, data-driven action plan for picking ...

Jorma Ollila

In this compelling memoir, Nokia’s legendary CEO Jorma Ollila presents a riveting story of the company that created the global ...

Jo Hausman

How do you weather the challenges of owning your own business while navigating personal tragedy and raising a child? Step ...

Sebastian Jespersen & Stan Rapp

A new business model for the digital age is the subject of an innovative book titled "Release the Power of ...

Joshua Spodek

If you want to attract and inspire people to get the job done with loyalty, dedication, quality, and to enjoy ...

Lee Ellis

Link honor and accountability together and you have a formula for great leadership. A healthy mindset of accountability can inspire ...

Dave Kurlan

Baseline Selling - How to Become a Sales Superstar by Using What You Already Know About the Game of Baseball, ...

Jess Todtfeld

Media Secrets: A Media Training Crash Course … Get More Publicity, Look & Feel Your Best AND Convert Interviews Into ...

James P. Ware, PhD

Are you frustrated by unfocused, boring meetings? Is your organization stuck in an unproductive meeting trap? Do you and your ...

Graham Hawkins

B2B sales is harder than ever before. Product life-cycles are getting shorter, sales cycles are getting longer, there are more ...

Danielle DiMartino Booth

After correctly predicting the housing crash of 2008 and quitting her high-ranking Wall Street job, Danielle DiMartino Booth was surprised ...

Colin Shaw

Many organizations are trying to improve their Customer experience as their Customer measures (NPS etc) plateau, but struggle to know ...

Lou Diamond

Making key connections in your life can launch your business, your sales, even your personal life and send them soaring ...

Erika Andersen

In Be Bad First, Erika Andersen proposes that success today depends on our ability to acquire new skills and knowledge ...

Steve Rizzo

MOTIVATE THIS! is filled with Rizzo’s unique brand of humor, insightful stories and mind-altering strategies that can elevate your overall degree of ...

Lea Woodford

What is your inner critic telling you? How are your values and standards holding you back? What can you do ...

Steve Napolitan

Get the proven 3-step process to attract more leads, gain more clients and, most importantly, increase revenue. This book will ...

Brigham Dickinson

What brings us to WOW and keeps us delivering WOW Experiences is our commitment to that noble cause, mission, and ...

Stacey Hanke

Do you feel confident you're a leader with influence? You may be surprised to discover you're not as influential as ...

Keeke Kawaii

This book is geared toward Anyone who has been through Anything! From Abandonment to Love, to Abuse to Regaining Strength ...

Matthew DiGeronimo

THE NAVY'S SILENT WARRIORS LIVE AND BREATHE OPERATIONAL EXCELLENCE. How does a group of 130 men with an average age ...

Mitch Axelrod

Sales master Mitch Axelrod has boiled down 75,000 hours of selling and business experience into one succinct playbook that shows ...

Scott Love

To achieve superior results as a leader, you must first understand why people follow. With this premise in mind, author ...

David Dye

As a manager, your life isn’t easy. You want your employees to trust and respect you, and you want to ...

Lee Bartlett, The No.1 Best Seller

What does it take to be a Top Salesperson? Many books claim to have the answer, but few show you, ...

Julie Miles Lewis :: Moving Mountains

Are you ready to move mountains, discover the mountain in you …. or maybe even climb one? In this leadership ...

Randall Kenneth Jones

It’s a Story for the Ages… Boy does well. Boy teeters on midlife crisis. Boy moves to Florida, becomes a ...

Shawn M. Miller

What others say about you is infinitely more powerful than anything you could say about yourself. This is true for ...

Heather F. Lutze, CSP

Marketing Espionage is essential to understand why your competitors enjoy web success and your own online efforts don't deliver. Leverage ...

Matthew J. Paese, Ph.D.

Better leaders, ready now. It's what successful businesses need to stay viable and what most are unable to achieve. The ...

Stan Rapp & Sebastian Jespersen

The advance from mass marketing to individualized marketing is about to take a quantum leap to the next big thing ...

Dan Negroni

Today, there are more than 83 million millennials in the United States, representing 36 percent of our workforce. By 2025, ...

Diane DiResta

Life is a presentation. The ability to present one's ideas quickly and efficiently is a significant resource in today's business ...

Daniel T. Bloom

In an environment where many organizations think of human capital assets as little more than expense items that impact the ...

Adam Toporek

Where do most customer experiences fail? It’s not systems. It’s not processes. It’s human beings. For most organizations, it’s frontline ...

Doug Sandler

In order to win relationships in today's business climate, you must first understand the importance of having systems in place ...

Joy Marsden

First, lead yourself. Leading yourself and others during turbulent times can be tricky, but great self-management and self-leadership doesn't come ...

Peter B. Stark and Mary C. Kelly

Why do so many leaders fail, and what do the best do differently? Thousands of leadership books tell you how ...

Andrew Mellen

"The Most Organized Man in America," sought-after pro organizer and coach Andrew Mellen has created unique, lasting techniques for streamlined ...

John T. Hewitt

So... what does it really take to WIN in your business? John Hewitt' s no-nonsense personal story will knock you ...

Angela Preston

In May 2014, I decided to quit the job that had run through my veins for so long and I ...

John David

The Essential Guide to Avoid Digital Damage, Lock Down Your Brand, and Defend Your Business With virtually nonexistent oversight, the ...

Jill Griffin

Corporate board seats are scarce and competition is fierce. That’s because board service bundles together a host of rewarding experiences: ...

Lance Secretan

Literature and history are filled with epic, romantic love stories Antony and Cleopatra, Napoleon and Josephine, Lancelot and Guinevere, Romeo ...

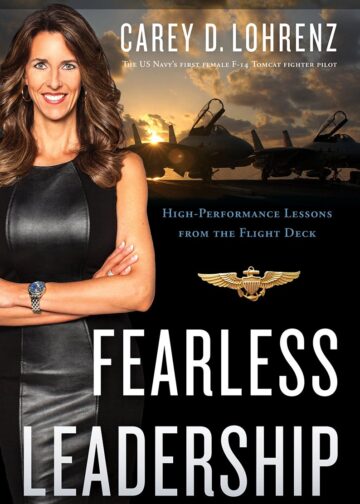

Carey D. Lohrenz

Wall Street Journal Bestseller, and #1 Amazon Bestseller in Leadership An F-14 fighter pilot's top lessons for leading fearlessly--and bringing ...

Jim Koch

In 1984, it looked like an unwinnable David and Goliath struggle: one guy against the mammoth American beer industry. When ...

Richard K Lee

This is a “How To Do It” book written by practitioners who have sat in the reader’s chair. Our Goal: ...

Joyce Layman

We’re stuck in an outdated maze of networking. The stacks of collected, untouched business cards threaten to tumble off your ...

Dave Fleming

Recycle, up-cycle, reconstruct, repurpose, and transform. Let’s face it. We love it when we see raw materials come together in ...

Greg Williams

With this latest book, Greg takes readers on a journey of enlightenment and unravels the vortex of uncertainty that some ...

Kathy Taberner & Kirsten Taberner Siggins

As leaders or parents (or both), navigating difficult conversations is part of our job description. How do we keep calm ...

Jim Doyle

Prime Time is a book for TV Sales Leaders who want a road map to success in the new TV ...

Jones Loflin

Juggling Elephants is a wonderfully lighthearted guide for everyone who feels like they're about to be squashed by all they ...

Atul Apte

The age of transformation is upon us. And for corporate IT departments, supporting and sustaining enterprise architecture requires a fundamentally ...

Scott Hansen

Have you ever said to yourself, "if I could only find out how these other entrepreneurs go to be so ...

Jason Forrest

Get ready to learn the purpose of a sales coach and over 70 principles that will transform you from a ...

Rob Pascale

Millions of baby boomers are just beginning to retire, and in doing so many are likely to run into adjustment ...

Harry R. Rozakis

Dodging Bullets, Shooting Back addresses the complex dynamics in today's business world with the clarity of someone who has lived ...

Connie Pheiff

Marketing Masters provides creative strategies combining the old school tricks of marketing with today's digital tactics to connect with the ...

Ilja Grzeskowitz

We live in tough times, and it seems many are unhappy with their circumstances in society, at work, or at ...

Chuck Gumbert

General George S. Patton was legendary for his battle planning and strategy as well as his straightforward, no nonsense approach ...

Chuck Gumbert

In Chuck Gumbert's second book, Pinnacle Leadership: How to Navigate Change, Move Forward and Reach Your Peak, he breaks down ...

Rick Gillis

As a kid, you were likely taught that modesty is the best policy. Better to let others discover your greatness ...

Drew Neisser

Imagine how much you would learn if you could talk to 64 of the brightest minds in marketing. Now imagine ...

Scott Jordan

Imagine Bill Gates and Giorgio Armani started a business, then hired PT Barnum to promote it, and Larry David to ...

Janna Hoiberg

Are you a member of a family in business together or, do you know someone in a family business? Then ...

Beverly E. Jones

For a thriving, durable career in today’s rapidly shifting world, you need to be adaptable and resilient. Being adaptable means ...

Sydney N. Fulkerson

The Coffee Run: And Other Internship Need-to-Knows is the what-to-do and how-to-do-it guide on internships for students. Based on real ...

Dan Veitkus

Are you tired of “Smart Talk” that leads nowhere? Can you tolerate one more expert spouting from a stage or ...

Donna Cutting

It's no secret that companies that deliver one-of-a-kind experiences for their customers create raving fans that return, refer, and clamor ...

Christopher S. Penn

Innovation. One of the most used words in business – yet one of the least understood. Without it, companies stagnate ...

Rory Vaden

Rory Vaden (Take the Stairs) brings his high-energy approach and can-do spirit to the most nagging problem in our professional ...

Rory Vaden

The New York Times bestseller that will help you get off the “escalator” and tackle the work that leads to ...

Steve Gilliland

DETOUR contains remarkable insight on how to deal with change and provides solutions to reduce stress, eliminate fear and increase ...

Steve Gilliland

HIDE YOUR GOAT is for every person who has ever said, "Why me?" It is for every person who feels ...

Steve Gilliland

In MAKING A DIFFERENCE, author Steve Gilliland brilliantly lays out three manageable means that make it possible for every person ...

Steve Gilliland

In ENJOY THE RIDE, author Steve Gilliland shares from his heart HOW TO EXPERIENCE THE TRUE JOY OF LIFE. A ...

Yitzchok Saftlas

So, What’s the Bottom Line? covers a wide array of topics relating to the business world, from marketing initiatives to ...

Daymond John

Daymond John has been practicing the power of broke ever since he started selling his home-sewn t-shirts on the streets ...

Peter Weedfald

Green Reign Leadership offers business executives as well as sales and marketing managers lessons, principals and rules to muscle up ...

Rich Horwath

The #1 cause of business failure is bad strategy and only 23% of executives are strong at strategic thinking. While ...

Maribeth Kuzmeski

What makes the world's most successful individuals so good at their jobs? What do they do that others don't? The ...

Sue Dyer

Partner Your Project is a step-by-step guide on how to develop working relationships that result in successful projects that are ...

Mark Sanborn

With Fred 2.0, Mark not only revisits the original Fred to gain new insights, but also equips all of us ...

Mark Sanborn

In You Don’t Need a Title to Be a Leader, Mark Sanborn, the author of the national bestseller The Fred ...

Randall Craig

Develop your reputation, get found, and attract a following You probably have a web site, blog, a LinkedIn profile and ...

Billee Howard

Today, the most successful businesses and entrepreneurs thrive through connectivity, socialization, and sharing. It is an age of WE-Commerce, an ...

Z. Christopher Mercer

Buy-sell agreements are among the most common yet least understood business agreements and many are destined to fail to operate ...

Jeff Fromm

While everyone was bemoaning their alleged laziness and self-absorption, the Millennial generation quietly grew up. Pragmatic, diverse, and digitally native, ...

Jeff Fromm

The numbers cannot be ignored: eighty million Millennials wielding $200 billion in buying power are entering their peak earning and ...

Mark Sanborn

In The Fred Factor, bestselling author Mark Sanborn relates the four principles of injecting passion into our work and life ...

Meridith Elliot Powell

Own It: Redefining Responsibility provides new and innovative solutions to one of today’s most pressing challenges – employee engagement. Top ...

Molly McGowan

You are probably closer to understanding personal branding than you realize. A lot closer. In fact, chances are that with ...

Shawn Casemore

This practical guide from an experienced leader in business fuses traditional operational tactics with the popular growing field of employee ...

Dr. Jim Bohn

This book cuts through Change Management theory and focuses on the actions executives must take to achieve the ROI of ...

Mari Anne Vanella

42 Rules of Cold Calling Executives (2nd Edition) is an easy to read book that gives concise, easy to implement ...

Lisa Ryan

One of the downsides of life is that we rarely have to deal with an overabundance of gratitude. Most of ...

Gianni Kovacevic

How One House Call Can Change Your Life A weekend service call changes the life of Doc Anderson forever. Johnny, ...

Jeffrey A. Barnes

Why did Walt Disney build Disneyland? Because Walt Disney wanted one! Can success really be that simple? It can be ...

Evan Hackel

Companies and leaders that have worked with Evan Hackel to put the philosophy of Ingagment into practice report the following ...

Bob Caporale

Creative Strategy Generation is a step-by-step guide to creating truly original and successful business strategies by tapping into one's own ...

Brian Solis

X: The Experience When Business Meets Design Welcome to a new era of business in which your brand is defined ...

Joe Sweeney

Through his book, Moving the Needle: Get Clear, Get Free, and Get Going in Your Career, Business, and Life, Joe ...

Jeffrey Hayzlett

Global business celebrity and prime-time Bloomberg Television host, Jeffrey W. Hayzlett empowers business leaders to tie their visions to actions, ...

Wally Hauck, PhD, CSP

A leader is a professional who is responsible for a standard of care of the organization and its stakeholders (employees, ...

Mitchell Rigie & Keith Harmeyer

"If the creators of brainstorming were alive today, they would be astounded at how far the concept has evolved. Rigie ...

Linda Kaplan Thaler

In Grit to Great, Linda Kaplan Thaler and Robin Koval tackle a topic that is close to their hearts, one ...

Doug Devitre

It’s not always possible for you or your team to meet with a client face to face. Screen to Screen ...

Stephen Garchow

To be successful, companies must effectively prioritize their near-term business goals with addressing longer-term strategic issues. Executives understand that strategic ...

Ron A. Carucci

It’s been known for decades that failure rates among transitioning executives are too high, leaving exorbitant costs, damaged organizations and ...

Sara Canaday

Learn the secrets of accelerating your journey toward success by better understanding yourself and how others perceive you. In You ...

Steve Broe

Based on interviews with 33 career changers who became leaders after a transition, LEADERS IN TRANSITION answers the question, "How ...

Richard Tyler

Everyone searches for success. While our ideas of success differ, a typical entrepreneur will define success in terms of accomplishing ...

Halelly Azulay

It has been estimated that 70 percent of employee development takes place through informal learning, rather than through formal learning ...

Kristen Brown

Get the bestselling book with hundreds of tips and ideas to help you create the low-stress, high-success life you envision ...

Rick Broniec, MEd.

If you're missing passion in your life and work, if your leadership seems blah and ineffective and if you've lost ...

Terry Sumerlin

Terry L. Sumerlin, amiable barber/philosopher and professional speaker, is a noticer who looks for meanings in all interactions. In this ...

Mike Moran

For years, Search Engine Marketing, Inc. has been the definitive practical guide to driving value from search. Now, Mike Moran ...

Sandy Jones-Kaminski

Everyone knows the feeling – you get to an event and, not knowing who to talk to or where to ...

Kevin Neff

Are you tired of the endless hype and nonsense being pitched to you by marketing sales people? Ever get frustrated ...

John Floyd

Have you heard the one about the comedian who was so deep in debt he was afraid to answer the ...

Nomi Bachar

GATES OF POWER: Actualize Your True Self is an inspirational, informative, and practical guide for all who are passionate about ...

Richard A Melancon, CPA

Take Your Company to the Top! Here's how: ** Align your values with the corporate mission, ** Transition from Manager ...

Ken Okel

Stop worrying about what to do next. You can achieve more in today’s pressure packed, ever changing business world. Stuck ...

Jasmine Sandler

How to Brand Yourself Online Like a CEO is a personal branding manual , available in ebook form on Amazon ...

Patti Hathaway, M.Ed, CSP

Nonstop change is now the workplace norm. According to a 2013 global survey, 82% of companies had undergone significant reorganizations ...

Marilyn Suttle

Every customer oriented business has its own Gladys; someone who demands more than most companies are able or willing to ...

Paul R. Williams

As the speed of business continues to increase, and as focus on an ever growing number of project data points ...

Liz Weber

Are you tired of working 50, 60, 70 or more hours a week? Do you come in early and stay ...

Allen Klein

You Can’t Ruin My Day contains 52 themes to help readers take back their power and not let other people ...

David Dye

Productive, energized, and innovative teams are critical to your success. In The Seven Things Your Team Needs to Hear You ...

David Rohlander

Inspirational and informative, The CEO Code shares real-life stories of success and failure from author David Rohlander's personal journey and ...

Chuck Reaves, CSP, CPAE, CSO

What every Chief Sales Officer needs to know about the advanced and changing world of sales. In this allegorical book, ...

Devin D. Thorpe

Devin Thorpe has collected over 150 essays on personal and family finance to help you learn how to be happier ...

Dale Partridge

WALL STREET JOURNAL BESTSELLER USA TODAY BESTSELLER Serial entrepreneur and business visionary Dale Partridge reveals seven core beliefs that create ...

Deb Calvert

Make every sales call count and be the ONE seller buyers want to talk to! With DISCOVER Questions™ , you ...

Dale Dixon

Mack is a man terrified of giving presentations. An unexpected mentor comes into his life and helps him realize a ...

Cindy Miller

Golf 101 for Executives is the perfect resource for anyone who needs to use the game of golf as a ...

Elizabeth Hagen

How many times have you dreamed of making something great happen in your life? In your work? In your relationships? ...

Ford Saeks

Superpower! How to Think, Act, and Perform with Less Effort and Better Results Download a FREE Book PreviewDo you want ...

Gina Abudi

While there are numerous project management books on the market and a number on business processes and initiatives, there has ...

C. Roy Hunter

Instead of just teaching you what to change, this book teaches you how to change...and to empower yourself by getting ...

Brad Szollose

Liquid Leadership presents a dynamic approach that will help readers avoid getting caught up in a workforce culture clash between ...

Gloria Petersen

Gloria Petersen’s "Seven Steps to Impressive Greetings and Confident Interactions" offers proven strategies to make your next interaction the first ...

Dawna Markova & Angie McArthur

A breakthrough book on the transformative power of collaborative thinking—essential reading for anyone who works as part of a team, ...

David Brooks

With the wisdom, humor, curiosity, and sharp insights that have brought millions of readers to his New York Times column and his ...

Gloria Petersen

Gloria Petersen’s "Seven Steps to Impressive Greetings and Confident Interactions" offers proven strategies to make your next interaction the first ...

Cathy Fyock

Your life's work is too important to simply begrudge and endure. A business parable for the ages, Hallelujah! will help ...

Danny Valenzuela

In his book, A Taste of Leadership™, Danny Valenzuela offers a taste of some fundamental practices of leadership and becoming ...

Daniel T. Bloom SPHR, Six Sigma Black Belt

Although world-class firms like GE and Motorola have relied on Six Sigma to build their performance cultures, these processes are ...

Richard J. Bryan

Frank was ex-special forces with a fine arts degree - an unusual mix! With his help, Richard Bryan turned around ...

Laura Leist

Eliminate the Chaos at Work increases your business productivity and peace of mind by showing you how to create streamlined ...

Michael Kerr

Attract and retain top talent, brand your business to stand out from the heard, energize employees, and turn customers into ...

Suzan St. Maur

HOW TO WRITE BRILLIANT BUSINESS BLOGS The no-bullsh*t guide to writing blogs that boost your brand, business and customer loyalty ...

Leo Willcocks

Stress often strikes at inconvenient times, when most stress management techniques would be embarrassingly obvious. Have you ever used yoga ...

Gillian Zoe Segal

In Getting There, thirty leaders in diverse fields share their secrets to navigating the rocky road to success. In an ...

Andrew Keyt

Myths & Mortals provides insights and strategies for successors of family businesses. Successors often find themselves in the shadow of ...

Bruce Weinstein

Employers look for two things when hiring or promoting people: knowledge and skill. They rarely, if ever, consider character. Yet ...

Betsy B Muller

Have you wondered if you have enough energy and clarity to get your to-do list completed with skill, quality and ...

Amy Florian

“No Longer Awkward” is the definitive guidebook for professionals who want long-term relationships with their clients. Inevitably, those clients face ...

Annette SImmons

Whoever Tells the Best Story Wins! Tell it to sell it! Help your customers make your story their story. Learn ...

Dianna Booher

What More Can I Say: Why Communication Fails and What to Do About It will provide nine counter-intuitive principles for ...

Jeanne Bliss

A Customer Experience Roadmap to Transform Your Business and Culture Chief Customer Officer 2.0 will give you a proven framework ...

Shelley Row

For a world of chronic over-thinkers, this book holds the key. In eight easy steps discover the essential role feelings ...

Ryan T. Sauers

Would You Buy from You? Many people cannot answer this question or struggle with it only to find that their ...

Shirley A. Weis

In this candid, authentic and inspirational book for women, Shirley Weis reveals her principles for winning the game in business. ...

Satish P. Subramanian

Organizations need to constantly innovate and improve products and services to maintain a strong competitive position in the market place. ...

Steven Kotler & Peter H. Diamandis

Bold: How to Go Big, Create Wealth and Impact the World Bold unfolds in three parts. Part One focuses on the ...

Spencer Rascoff & Stan Humphries

Enter Zillow, the nation's #1 real estate website and mobile app. Thanks to its treasure trove of proprietary data and ...

Randy Fox

Our world is starving for real leaders to truly become a success by being strong in their ethics and convictions ...

Mark Hunter

High-Profit Selling: Win The Sale Without Compromising on Price Too many sales professionals rely upon discounts to close sales, but ...

Troy Hazard

After years as a consultant to some of the world's biggest brands and a serial entrepreneur, Troy Hazard has learned ...

Dr. Rick Goodman, CSP

What do all championship athletes and teams have in common with the world's most successful people? They all have a ...

Monica Wofford

We all have at least one person we wish we could make disappear...without getting in trouble! It’s not magic. It’s ...

Mindy Gibbins-Klein

Thought leadership has become a popular phrase and idea, but many times what is called thought leadership is actually quite ...

Laszlo Bock

WORK RULES! shows how to strike a balance between creativity and structure, leading to success you can measure in quality ...

John Zaleski

Within a healthcare enterprise, patient vital signs and other automated measurements are communicated from connected medical devices to end-point systems, ...

John Sviokla & Mitch Cohen

There are about 800 self-made billionaires in the world today. What enables this elite group to create truly massive value, ...

John Kounios & Mark Beeman

In The Eureka Factor, John Kounios and Mark Beeman explain how insights arise and what the scientific research says about stimulating more ...

Jessica Jackley

In the tradition of Kabul Beauty School and Start Something That Matters comes an inspiring story of social entrepreneurship from the co-founder of Kiva, ...

Dan Veitkus

Straight Talk Your Way to Success Are you tired of “smart talk” that leads to no good outcome? Do you ...

Maria Ross

The popular guide used by entrepreneurs, start-ups, small businesses and non-profits everywhere to build an irresistible brand on any budget ...

Kathleen Burns Kingsbury

YOUR ONE-STOP HANDBOOK FOR CONNECTING WITH AFFLUENT FEMALE INVESTORS During the next several decades, women will inherit approximately $28.7 trillion ...

Lauran Star

Today women are entering the workforce and leadership field at an extensive rate; however, they are struggling to gain a ...

Linda J. Popky

Marketing today is out of control. With all the new marketing techniques accessible to the masses, it’s becoming harder and ...

Debra Fine

Nationally recognized communication expert Debra Fine reveals the techniques and strategies anyone can use to make small talk--in any situation. ...

Kristin Arnold

Boring to Bravo by Kristin Arnold shows experienced presenters how to transform boring monologues into scintillating dialogues by employing simple yet powerful ...

Michael Fertik

Your reputation defines how people see you and what they will do for you. It determines whether your bank will ...

Nicholas Carlson

When Yahoo hired star Google executive Mayer to be its CEO in 2012 employees rejoiced. They put posters on the ...

Thom Singer

Some Assembly Required: How to Make, Grow and Keep Your Business Relationships by Thom Singer is based on the premise that ...

Kevin Ashton

As a technology pioneer at MIT and as the leader of three successful start-ups, Kevin Ashton experienced firsthand the all-consuming ...

Kabir Sehgal

In Coined: The Rich Life of Money And How Its History Has Shaped Us, author Kabir Sehgal casts aside our workaday ...

Gary Patterson

Million Dollar Blind Spots by Gary Patterson will create clear understanding to uncover blind spots in your company-and will dramatically accelerate ...

David Avrin

Raise your profile and get the attention you deserve -- or your business, your brand, or yourself! Almost everyone who ...

Dave Delaney

Supercharge the way you build business relationships—online and off! Business success is all about connections, relationships, and networks! In New ...

Daniel Lubetzky

In Do the KIND Thing, author Daniel Lubetzky shares the revolutionary principles that have shaped KIND’s business model and led to ...

Bruce Turkel

Have you ever wondered why almost identical products sell for vastly different sums just because of the name or logo ...

Bob Dailey

Whether you manage a department of three employees, or an international organization with thousands of employees, one thing impacts your ...

Gisela Hausmann

In today’s world, we need more than determination to reach our goals; we need naked determination. Applying this powerful momentum ...

Milo Shapiro

You CAN master the skill of public speaking! Laugh your way through Milo’s clever, tip-loaded “Top 10 Lists”. Conquer any ...

Patty Chang Anker

SOME NERVE: Lessons Learned While Becoming Brave (Riverhead), a Books for a Better Life Award finalist which Oprah.com calls "Downright ...

Dave Kerpen

The NEW YORK TIMES and USA TODAY bestseller—updated with today’s hottest sites! A friend’s recommendation is more powerful than any ...

Rita Burgett-Martell

People don't resist change if they are prepared for change. Change Ready! How to Turn Change Resistance into Change Readiness, by ...

Chris Roebuck

Across the world millions of people aren’t inspired at work or given the opportunity to give their best and fulfill ...

Chris Westfall

With digital media, customers today have more ammunition than ever. That's why you've got to have a BulletProof Brand. With ...

Jeff Nischwitz

Unmask is a road map for navigating your own personal journey as a leader in your business, career, relationships and ...

Jeff Slutsky

For any business owner, franchise operator, or marketing executive who seeks to increase sales while lowering marketing costs, Jeff Slutsky ...

Joseph Sherren

Leadership is about creating a culture which will engage all employees in executing the Vision and Mission of the company. ...

Josh Linkner

Companies, communities, and individuals fall for many reasons, but one of the most common--and easily avoidable--is the failure to reinvent. ...

Karen Friedman

In today's high-tech world, there are more ways than ever before to communicate: email, text messaging, voicemails, blogs, tweets, video ...

Phil Weinzimer

Based on interviews with more than 150 CIOs, IT/business executives, and academic thought leaders, The Strategic CIO: Changing the Dynamics ...

Michelle Tillis Lederman

Michelle Tillis Lederman shows how networking can be as easy, enjoyable, and fulfilling as having a conversation with friends—and still ...

Ted Rubin

In today’s digital world it’s all too easy for us as brands and individuals to let our relationship-building muscles atrophy. ...

Shelly Alcorn & Willis Turner

Play predates the development of human culture and our brains are hard-wired to use play as a tool to accelerate ...

Alice Nagle & Luanne Tierney

In today's competitive, global, connected, and fast-paced business environment, how do young women get career savvy quickly? Two Silicon Valley ...

Dan Gregory & Kieran Flanagan

Selfish, Scared & Stupid outlines the three most common human traits: selfishness, fear and a need for simplicity. To effectively increase ...

Robbie Kellman Baxter

In today’s business world, it takes more than a website to stay competitive. The smartest, most successful companies are using ...

Wally Hauck

The aim of this book is to compel leaders to replace their typical performance appraisal methods with one more closely ...

Timothy Keiningham

Customer Loyalty Isn't Enough. Grow Your Share of Wallet! The Wallet Allocation Rule by Timothy Keiningham is a revolutionary, definitive guide for ...

Steven Rosen

52 Sales Management Tips is written for sales managers who struggle within a corporate environment that doesn't always support them ...

Stephen Sapato

Become The Go-To Person For Your Own Success by Stephen Sapato teaches small business owners and entrepreneurs how to realize tremendous ...

Ruth Ross

Coming Alive: The Journey To Reengage Your Life And Career by Ruth Ross is the prescription for anyone who has ever ...

R. Michael Anderson

Stressed? Overwhelmed? Burned Out? Learn transformational life skills in this exciting new modern business fable by acclaimed expert R. Michael ...

Paul Axtell

America has become a nation “stuck in a meeting.” Between corporate boardrooms, all hands meetings, and conference calls, few of ...

Neen James

Folding Time™ by Neen James is about being accountable for our time, engaging our attention and leveraging our energy. In ...

Nadine Vogel

"Dive In: Springboard into the Profitability, Productivity, and Potential of the Special Needs Workforce" by Nadine Vogel, enlightens readers regarding ...

Matt Heinz

The speed of innovation and change in B2B marketing has never been greater. And the need for clarity for a ...

William Hawfield

Game-Changing Advisory Boards offers a proven process for creating and maintaining sustainable value in your business. William Hawfield and John ...

Jeff Davidson

In an era that offers too many choices and too much information, people’s lives aren't getting simpler. In fact, just ...

Don Crawley

Now in its third edition, The Compassionate Geek by Don Crawley, was written by a tech person for tech people. There ...

David Giannetto

It's easy for today's leaders to fall into the trap of accepting trendy big-data, social media, and mobile technology initiatives ...

Mark Sephton

DISCOVER who you are. IMAGINE who you could be, and ACHIEVE all the potential within you. We are all only ...

David Long

Did you know that of every 100 employees hired, only 6 or 7 will ever be promoted to their first ...

Brian Basillico

If you are looking for a “How-To” social networking book, then this is not for you. This is a “Why-To” ...

Malcolm Gladwell

In this stunning new book, Malcolm Gladwell takes us on an intellectual journey through the world of "outliers"--the best and ...

Eric Schmidt

Google Executive Chairman and ex-CEO Eric Schmidt and former SVP of Products Jonathan Rosenberg came to Google over a decade ...

Dave Ramsey

If you will live like no one else, later you can live like no one else. Build up your money muscles with ...

Daniel Kahneman

In the international bestseller, Thinking, Fast and Slow, Daniel Kahneman, the renowned psychologist and winner of the Nobel Prize in Economics, takes us ...

Peter Shankman

Marketing and PR expert Peter Shankman has been working with the biggest companies in the world to create what he ...

Steven D. Levitt

Now, with Think Like a Freak, Steven D. Levitt and Stephen J. Dubner have written their most revolutionary book yet. With ...

Tony Robbins

Tony Robbins has coached and inspired more than 50 million people from over 100 countries. More than 4 million people ...

Walter Isaacson

Following his blockbuster biography of Steve Jobs, The Innovators is Walter Isaacson’s revealing story of the people who created the computer and ...

Tony Alessandra

Imagine... When you encounter difficult people - you know how to adapt to them. Where you meet challenging situations - ...

Andy Paul

Salespeople today face a fast-paced and increasingly crowded marketplace where meaningful product differentiation has all but disappeared. To compete success ...

Shelly Palmer

Why You Need Digital Wisdom The goal of this book is to give you a way to think strategically about ...

Dave Pottruck

Change is a constant, and leaders must do more than keep up--they must innovate and accelerate to succeed. Yet people ...

Tony Alessandra

In this entertaining and thought-provoking book, Tony Alessandra and Michael O'Connor argue that the "Golden Rule" is not always the ...

Jay Baer

The difference between helping and selling is just two letters. But those two letters are critically important to your company’s ...

Stephen Shapiro

In times of reduced funding, tighter deadlines, and fewer resources, a different approach to innovation is required. Unfortunately, concepts such ...

Shari Harley

We all know how it feels when our colleagues talk about us but not to us. It’s frustrating, and it ...

Erin Botsford

This is a guidebook packed with the best strategies to manage wealth in retirement, helping readers live the life they ...

David Newman

As a small-business owner or solopreneur, you wear many hats--perhaps the most important of which is marketer. But these days, ...

Cindy Goldsberry

There is no magic bullet for sales success…and a focus just on sales skills, lead gen tactics and sales process ...

Christine Comaford

Are You Scaring Your People into Mediocrity? All leaders want to outperform, outsell, and outinnovate the competition. And most teams ...

Salim Ismail

For hundreds of years, traditional business structures have put an organizational/legal boundary around an asset or a workforce and 'sold' ...

Marcia Reynolds

Leaders, managers, and coaches are charged with getting people to stretch their limits but are often unsuccessful. Top leadership coach ...

David Poulos

Everyone can “do” marketing . . . right? Marketing Doctor’s Survival Notes is a collection of essays, articles, blog posts ...

David Goldsmith

Have you ever thought about the fact that a craftsman has more and better tools to solve challenges on the ...

Joe Calloway

Winners in business aren't the ones who do the most things; the winners are the ones who do the most ...

Gina Carr and Terry Brock

Build Credibility, Get More Business, and Increase Profits with DIGITAL INFLUENCE Strong influence translates to more business--and nothing measures influence ...

Peter Shankman

The era of authoritarian cowboy CEOs like Jack Welch and Lee Iacocca is over. In an age of increasing transparency ...

Larry Winget

The straight-talking, New York Times bestselling author and Pitbull of Personal Development® is back with a pithy and prescriptive guide to success. ...

Mark Sanborn

Nine years ago, bestselling author and business consultant Mark Sanborn introduced the world to Fred, his postman, who delivered extraordinary ...

Randy Gage

Risky Is the New Safe is a different kind of book for a different kind of thinking—a thought-provoking manifesto for ...

Dana Manciagli

Cut the Crap, Get a Job! A New Job Search Process for a New Era is a revolutionary job search ...

David Horsager

In The Trust Edge, David Horsager reveals the foundation of genuine success—trust. Based on research but made practical for today’s ...

Joanne Black

Over the last decade, the rapid growth of social media, the emergence of the cloud, and a myriad of other ...

Dorie Clark

A step-by-step guide to reinventing you Are you where you want to be professionally? Whether you want to advance faster at ...

Christopher Brown

BECOME THE ENVY OF YOUR INDUSTRY WITH A CUSTOMER-CENTRIC CULTURE For the first time, this groundbreaking guide unlocks the secrets ...

Ted Rubin and Kathryn Rose

Return on Relationship™ (ROR), simply put, is the value that is accrued by a person or brand due to nurturing ...

Keith Ferrazzi

The bestselling business classic on the power of relationships, updated with in-depth advice for making connections in the digital world. ...

Judy Robinett

"Other people have the answers, deals, money, access, power, and influence you need to get what you want in this ...

Michael Parrish DuDell

From the ABC hit show "Shark Tank," Shark Tank Jump Start Your Business is filled with practical advice on how ...

Lisa Nirell

Today’s marketers face a perilous journey. As a result of new buyer dynamics, a boardroom-level obsession with marketing ROI, and ...

Mildred Talabi

Successful job hunting isn’t about luck, chance, or hope… Successful job hunting is a SCIENCE! In her ground-breaking book, The ...

Jim Collins

The Challenge: Built to Last, the defining management study of the nineties, showed how great companies triumph over time and ...

Sarah Caldicott

Thomas Edison's innovations contributed a whopping 3% of global GDP at the time of his death in 1931. Edison created ...

Daymond John

In Display of Power: How FUBU Changed a World of Fashion, Branding and Lifestyle, Daymond John (Founder and CEO) gets to the ...

Michael Houlihan and Bonnie Harvey

About The Barefoot Spirit It is hard to believe that such an iconic brand as Barefoot Wines began in a laundry ...

Sheryl Sandberg

Thirty years after women became 50 percent of the college graduates in the United States, men still hold the vast ...

Gary Vaynerchuk

New York Times bestselling author and social media expert Gary Vaynerchuk shares hard-won advice on how to connect with customers ...

Arianna Huffington

Arianna Huffington's personal wake-up call came in the form of a broken cheekbone and a nasty gash over her eye ...

Andy Frawley

A new data-driven approach to building customer relationships that fuel sustainable business growth Igniting Customer Connections explores how organizations of all ...

D. Keith Pigues

Do your customers make more money doing business with you? Knowing the answer can help you build measurable and valuable ...

Dirk Beveridge

We are living in disruptive times. In fact 76% of distributors surveyed believe we are living in an environment we ...

Steven Haines

Every day, thousands of new products and innovations are brought to market. Amid much fanfare, they struggle for shelf-space, mind-share, ...

Sylvie di Giusto

The Image of Leadership is the result of Sylvie di Giusto’s journey through two career paths: one in the field of human resources, ...

Dov Baron

Everything you’ve been told about leadership over the past thirty years no longer applies. The world has changed, and so ...

Jack Daly

HYPER SALES GROWTH — Jack Daly’s street-proven systems & processes. How to grow quickly & profitability. Dive into three critical areas: ...

Nathan Jamail

Creating a Coaching Culture to Build Winning Business Teams There are enormous differences between managing and coaching. Yet many companies ...

Josh Allan Dykstra

Why is it that so many of us toil away in jobs we hate, being treated like machines, doing things ...

Shep Hyken

You must deliver an amazing customer experience. Why? It is the competitive edge of new-era business–in any market and any ...

Scott McKain

Inspired by the Ideas and Insight of Taxi Terry…The Best Guide to Customer Service You Will Ever Read No matter ...

Peter Friedman

It's a terrific time to be a senior marketing leader-if you're prepared to leverage social effectively, and with time, utilize ...

Eugene Montanez

In his book, “Direct Mail is NOT Dead,” Eugene Montanez explains the importance of an effective call to action. Not only ...

Dina Simon

Make Unstoppable Simple Being unstoppable doesn’t mean you are never blocked or stuck on your way through life. It means ...

Adrian Ott

Exponential Influence®: Designing Digital Habits That Engage Distracted Customers Everyone knows that repetition forms habits. But did you know that repetition ...

Lee Frederiksen

What does it take to become a well-known expert in your field — someone other practitioners and the media seek ...

Robert Sher

Most midsized company leaders want their businesses to become mighty growth machines. Unfortunately, sometimes that growth slows, stops, or goes ...

Robert Cialdini

Influence: Science and Practice is an examination of the psychology of compliance (i.e. uncovering which factors cause a person to ...

Allison Graham

Want to supercharge your life? Getting connected & building authentic, profitable relationships is the answer and this book will teach ...

David Meltzer

There are seven interconnected principles that are applicable to our lives in general and just as relevant to more specific ...

Kevin Popović

Inside 20YEARS Communications, 20 leaders from different corners of the industry answer 20 questions on the evolution of communications, providing ...

John Brubaker

The Coach Approach: Success Strategies From The Locker Room To The Board Room is a book designed to help business ...

Mindy Hall

Too often executives allow their functional roles to define who they are as leaders. Instead, they should focus on the ...

Steven Overman

A generation of people around the world, from Boston to Bangkok, from New York to New Delhi, are making everyday ...

Tom Hopkins

This is a complete and practical guide which highlights the authors' new strategic approaches to selling when the buyer initially ...

Tom Spitale and Mary Abbazia

A practical guide for inexperienced marketers who have to develop a marketing strategy With technology being built into products of ...

Ted Wright

"Word of mouth marketing has always existed. We've just found a better and more efficient way to do it." -- Ted ...

Paul Jankowski

Speak American Too: Your Guide to Building Powerful Brands in the New Heartland is the definitive field manual to marketing ...

Kaihan Krippendorff

A Fast Company blogger and former McKinsey consultant profiles the next generation business strategists: the "Outthinkers" "Outthinkers" are entrepreneurs and ...

Joel Trammell

Joel Trammell’s new book, The CEO Tightrope: How to Master the Balancing Act of a Successful CEO, prepares seasoned and ...

Colleen Francis

Put an end to boom and bust sales cycles - once and for all! Do your company's sales results lurch ...

Albert Dunlap

Al Dunlap is an original: an outspoken, irascible executive with an incredible track record of injecting new life into tired ...

Dale Carnegie

For more than sixty years the rock-solid, time-tested advice in this book has carried thousands of now famous people up ...

David Sturt

Great work lives inside all of us. We've long been told our ability to succeed depends on our IQ, talent, ...

Dan Waldschmidt

Everything you think you know about success is wrong! Set Goals. Work Hard. Be Persistent. That's the typical success advice ...

Lee B. Salz

It's the revolving door on sales teams. Executives hire who they believe to be great salespeople, but the results never ...

Bob Urichuck

Sales is the lifeline to your bottom line. Without sales, there are no transactions, without transactions there is no revenue, ...

Suzanne Garber

SAFETY NETwork: A Tale of Ten Truths of Executive Networking is the story of Ralph Pibbs, former international executive, corporate ...

Dr. Thomas Rose

In diesem Buch geht es nicht nur um die Beschreibung einer Reise nach Indien, sondern es geht um Selbstbestimmung und ...

John Tschohl

This is the 10th Edition. Many call this book the bible of customer service. It focuses on the strategy on ...

Terry Rich

Dare to Dream, Dare to Act is an unconventional biography filled with real stories of creativity, innovation, risk and success. ...

Sehin Belew

My book is written for someone who wants to take the guess work out of what to eat, what to ...

Stephanie Dollschnieder, MA

Discover the secrets of effective customer communication (both internal and external)and watch your business grow. Contact, Care, COMMUNICATE contains insights ...

Mitchell Gooze & Ralph Mroz

The book shows companies how to leverage 20th century accomplishments into a 21st century competitive advantage. This book identifies where ...

David Grossman, ABC, APR, Fellow PRSA

Everything you do communicates something, whether you intend to or not. The most effective leaders choose to make the most ...

David Grossman, ABC, APR, Fellow PRSA

Everything you do and say communicates SOMETHING. So not communicating is not an option. In fact, the most effective leaders ...

Mike Hawkins

It has long been said that you can do anything you put your mind to. Yet in this groundbreaking book, ...

Tod Novak