By Rob Docters author of Ethics and Hidden Greed

Building a trustworthy brand is crucial for any business to succeed in today’s competitive market. However, gaining customers’ trust is not built upon a list of attributes or a checklist but an outcome of ethical behavior and values. In addition, social media allows businesses to gather information about people’s concerns and express themselves through better targeting the audience.

However, a company builds its brand through behavior, usually transmitted to potential buyers. The most successful companies instill their beliefs in every employee and don’t allow their salespeople to manipulate transactions to build a brand. Customers own brands, and they are not commodities. They want to know they are getting a quality product or service at a fair price.

Values, Behavior, and Trust

Knowing your values is crucial, not just for being suitable, which does not resonate with consumers, but for inspiring many decisions. For example, ExxonMobil aims to know where every gallon of gasoline is, from the well-head to the gas pump. You may say: “Oil is a commodity; it has no brand.” That would be wrong. Customers’ perception can easily alter the distinction between narrow and broad trust. If you are a product manager, then your goal is the value and price of a phone. If you are the company president, you had better think more broadly.

Pricing

The context for the pricing decision is what determines the price. For instance, Walmart gets a different price for Coke depending on where it’s displayed—its value changes when surrounded by Pepsi versus sporting goods.

It is crucial to understand customers and which of several categories of decision-making they go to. For example, a consumer bank had customers who hated banks and just wanted to “fly below the radar.” This segment was attracted to the bank, even if their intention did not sit well with the bank. At the same time, online-only consumers were not interested in guarantees and assurance regarding Internet banking and felt comfortable. They felt more adept than the bank, so the entire marketing pitch had to be flipped from safety to convenience, convenience, and convenience.

Building a trustworthy brand is an ongoing process that requires continuous effort and attention.Businesses can establish themselves as reliable and trustworthy brands that customers can rely on by taking a proactive approach to understanding their customers’ needs and concerns. Companies can better target their audience and deliver high-quality products and services that meet their customers’ expectations. Building a trustworthy brand is not just good for business; it’s essential for success in today’s marketplace.

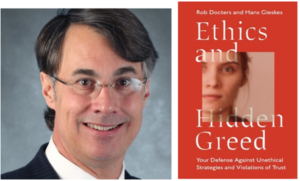

ROB DOCTERS

ROB DOCTERS recently co-authored Ethics and Hidden Greed. Your Defense against Unethical Strategies and Violations of Trust. He is Partner at Abbey Road, LLP, leading their ethics practice. He formerly led BCG’s pricing practice in Asia/Pacific.

Building a trustworthy brand should be a high priority for almost any business to succeed in today’s competitive market. How to do this? Gaining customers’ trust is complex, not built upon a list of attributes or a checklist. Instead, it is the result of instilling ethical behaviors and values. These aspects have always been important, but today social media can make ethical issues rapidly grow to be significant.

However, a company builds its brand through behavior, usually transmitted to potential buyers. The most successful companies instill their beliefs in every employee and don’t allow their salespeople to manipulate transactions or customer care to be dismissive of building their brand. Its customers who ‘own’ your brand. They want to know, without checking, that they are getting a quality product or service at a fair price.

Values, Behavior, and Trust

Knowing your values is crucial for product development so that all activities resonate with consumers and inspire many decisions. That applies to almost all markets. For example, ExxonMobil’s profits lie in reaping the value of superior lubricants and oil. You may say: “Oil is a commodity; it has no brand.” That would not be true. Not only do lubricants vary in quality, but buyers get a cue about performance and value from how the company presents and markets these products.

Trust in a brand comes in two forms: narrow and broad, depending on the product. Narrow means evaluating each transaction. Broad means that customers form a view of the seller, and only if disproved does that perception evolve. Customers remember an experience, especially negative ones. If you are a product manager, then your goal might be narrowly the value and price in a specific sale. If you are the company president, think more broadly about the relationship.

Pricing

The context for the pricing decision is what determines the price. For instance: Walmart obtains a different price for Coke products depending on where it’s displayed—market price changes when surrounded by Pepsi versus sporting goods.

It is crucial to understand the decision criteria customers rely upon. For example, a consumer bank found that some customers, who “hated” banks, just wanted to “fly below the radar.” This segment was attractive to the bank, even if their views contradicted their aspirations. At the same time, online-only consumers were not interested in obtaining guarantees and assurance regarding Internet banking. They felt more adept than the bank, so the entire marketing pitch had to be flipped from safety to convenience, convenience, and convenience.

Building a trustworthy brand is an ongoing process that requires using the right levers. Unfortunately, many companies do not meet that requirement. Businesses can establish themselves as reliable and trustworthy brands that customers can rely on by taking a proactive approach to build ethical standards for all transactions—large and small (often taken as an indication of the overall relationship). Generally, this means employee behavior in customer interactions, ensuring their fidelity to values. Building a trustworthy brand is not just good for business; it’s essential for company success.