No products in the cart.

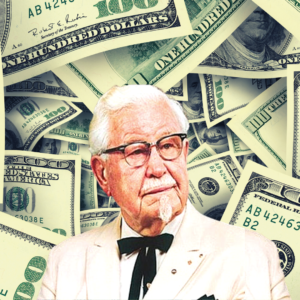

The ‘finger-lickin’ good’ chicken has been dominating the American fast food fried chicken for decades after a man named Harland Sanders mastered his 11 herbs and spices recipe. But not many people these days know, that he did it from inside his gas station during the Great Depression.

It started way back in the 1930s when Colonel Sanders, who went by his name Harland Sanders back then was running a gas station in his home town in Kentucky.

Here’s the full story…

WATCH:

From Gas Station to Multi Billion KFC Franchise

Harland was born in 1890 and raised quick on a farm outside Henryville, Indiana. His father died when he was just five years old. The oldest child, Sanders was left to care for his two siblings.

His mother taught him how to cook when he was seven. By 13, Sanders left home to pursue a series of professions including railroad worker and insurance salesman. Neither panned out.

In 1930, he took over a Shell filling station on US Route 25 just outside North Corbin, a small city on the edge of the Appalachian Mountains. It was at this gas station when he converted a storeroom into a small eating area using his own dining table, originally serving home cooked meals like steaks, country ham, and fried chicken to his gas station customers. He called his side hustle, Sander’s Café.

Things were going great until one day when became absolutely obsessed with the thought of mass producing fried chicken. Here’s why…

The Simple Invention That Made KFC Immortal

Sanders was supper dissatisfied with the 35 minutes it took to prepare his chicken in an iron frying pan. Time is money and during the Great Depression, his customers couldn’t didn’t have either to spare.

To make matters more complicated, Harlen refused to deep fry. Although a much faster process, in Sanders’ opinion it produced dry and crusty chicken that was unevenly cooked.

The on the other hand, if he prepared the chicken in advance of an order, there was sometimes waste at the end of the day. Then a new product emerged…

In 1939, the first commercial pressure cookers were released, predominantly designed for steaming vegetables. Sanders bought one and modified it into a pressure fryer, which he then used to prepare chicken. The new method reduced his production time to be comparable with deep frying, while simultaneously retained the quality of pan-fried chicken. Now he could prepare high volumes of quality fried chicken at scale.

That is, as long as he could get anyone to buy into the his franchise model.

How Did Harland Sanders Franchise KFC?

In July 1940, Sanders finalized what later became known as his Original Recipe of 11 herbs and spices. Although he never publicly revealed the recipe, he admitted to the use of salt and pepper, and claimed that the ingredients “stand on everybody’s shelf”.

Sanders hit the highways pitching his chicken concept to as many restaurant owners he could meet. Independent restaurant owners would pay four cents on every piece of chicken sold as a franchise fee, in exchange for Sanders’ his recipe and method, and the right to advertise using his name and likeness.

Coined the name “Kentucky Fried Chicken”. Sanders adopted the name because it distinguished his product from the deep-fried “Southern fried chicken” product found in restaurants. Tripling his sales in the first year alone.

That’s when he met Wendy’s future founder Dave Thomas…

The Time Sanders Met the Future Founder of Wendy’s

By 1956, Sanders had six or eight franchisees, including Dave Thomas, who eventually founded the Wendy’s restaurant chain. Thomas developed the rotating red bucket sign, was an early advocate of the take-out concept that Harman had pioneered, and introduced a bookkeeping form that Sanders rolled out across the entire KFC chain. Thomas sold his shares in 1968 for $1 million and became regional manager for all KFC restaurants east of the Mississippi before founding Wendy’s in 1969.

For more on that story, here’s the Wendy KFC connection covered in this story: WATCH: Abandoned by Parents, Kid Vows to Be Successful. Builds $4B Wendy’s Fortune

Then, in another random series of cosmic associations, here’s the brief time a serial killer was made a KFC franchise manager at the request of his father in law..

The Time When a Serial Killer Became a KFC Manager…

In the 1960s, John Wayne Gacey was made manager of several Iowa KFC franchises where also around this time and would start his murder spree raping, torturing and murdered at least 33 young men and boys. Gacy regularly performed at children’s hospitals and charitable events as “Pogo the Clown” or “Patches the Clown”, personas he had devised.

There’s currently a documentary that covers the story on Netflix called Conversations With a Killer: The John Wayne Gacey Tapes.

It looks absolutely freaking terrifying…

Outside of the documentary, it’s often claimed that Gacy was such a fan of his workplace, he would provide free fried chicken to his colleagues and even insisted on being called the ‘Colonel’.

It would seem his love for the chain continued right up until he was put to death by lethal injection at the age of 52. His last meal request? A bucket of original recipe KFC.

The Fast Rise of the KFC Franchise

In 1960 the company had around 200 franchised restaurants; by 1963 this had grown to over 600, making it the largest fast food operation in the United States. At 73 years old, Harland Sanders sold KFC for $2 million in 1964 ($17.5 million in today’s dollars).

The company went through multiple acquisitions over the years to eventually Pepsico than Yum Brands who still owns and operates the franchise today. Yum Brands operates KFC, Pizza Hut, Taco Bell and The Habit Burger Grill.

Today KFC is pulling in $2.793 billion in revenue with 22,621 locations across 150 countries. And it all started in a gas station in Kentucky…

For more information visit tylerhayzlett.com