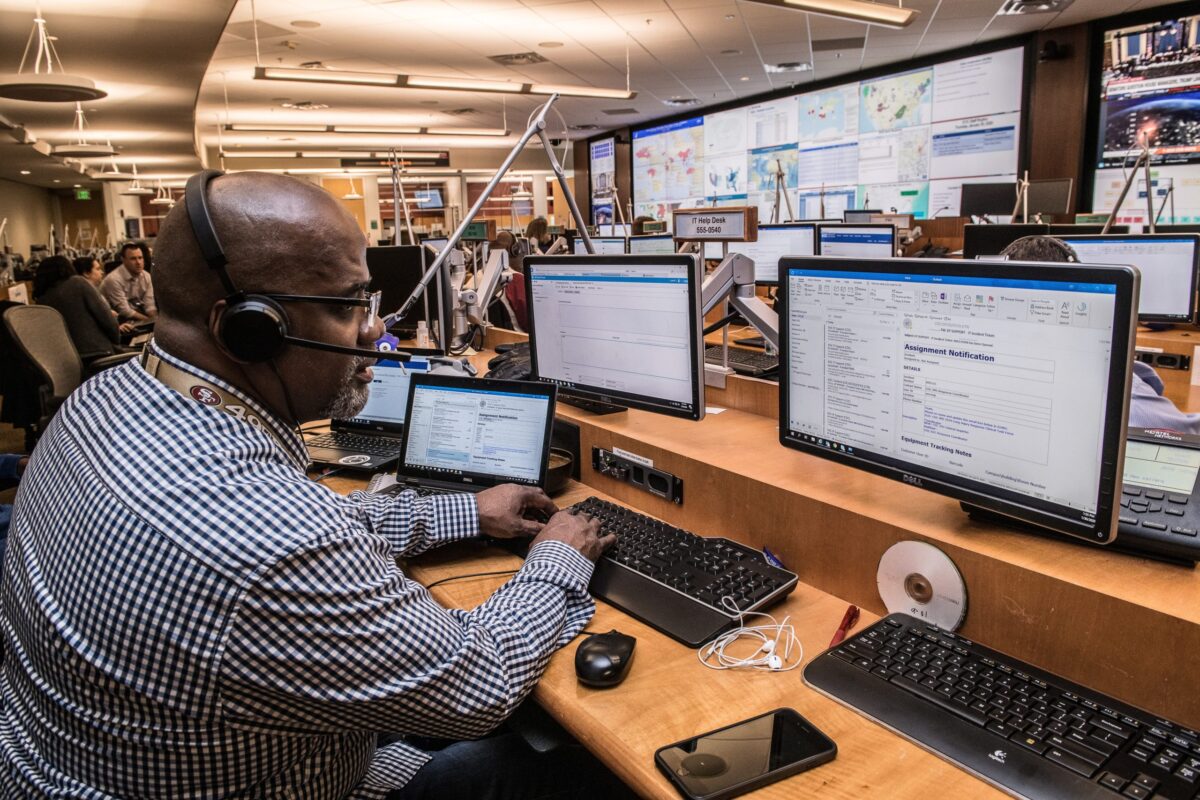

If the statement below should resonate with your customer, you probably operate in a mission-critical sales environment.

“(What I sell) is Cheap. It’s Trouble that’s Expensive”.

The mission critical sale is when your offer can affect your customer’s business or operations in some significant way. Note the emphasis on “should” and “can”; I’ll get to that later on.

Examples might include:

- Complex/Technical capital equipment

- Medical tech and new technology

- Custom & Semi-custom products & services

- Differentiated components

- Corporate software, including SaaS/cloud delivered.

The Mission-Critical Sale Moves Beyond Consensus Selling.

Full disclosure: I’ve been selling and consulting in “the complex sale” (aka consensus selling) for decades. I understand it and am a huge fan. I’m beyond “drinking the Kool-aid”. I’m marinated in it.

I also know what consensus selling methodologies are and aren’t.

They are for organizing opportunity pursuit strategy when a buying ecosystem — multiple personas – is making a group buying decision. Usually, this ecosystem is made up of personas somebody thinks should be included. Unfortunately, complex selling methodologies often assume that “somebody” defined the group properly.

Complex sales methodologies aren’t for expanding a buying ecosystem strategically (methodologies accommodate expansion just fine, they just don’t teach it). Typically, companies buy in organizational silos, applying a self-imposed set of blinders to their decision. Thus, they buy too narrowly, engaging prospective vendors constrained by their own narrow perspective. It’s not your customers’ fault: they aren’t experts in your offer’s capabilities and don’t understand all of its implications.

When One Silo Has Budget, But Many Silos Benefit

Unfortunately, selling organizations who blindly accept a predefined buying ecosystem almost always overlook potential stakeholders. This is for a variety of reasons, but the result is that sellers miss potential differentiation leaving value unrecognized. Consequently, opportunity strategy under-powered…a potentially mission-critical sale is reduced to a run-of-the-mill complex sale.

- Imagine this scenario: You’ve gained consensus from your regular personas, to the point of mildly irritating the purchasing agent. Proudly, you know what every persona wants, and each feels your offer fits their needs. It’s smooth sailing until your coach calls: you’re on the outside looking in. Astonishingly, a competitor has penetrated throughout the organization — to departments you didn’t even know cared — and somehow to executives who told you that the personas you were working with were “the right team”. Worse, their proposal was higher priced than yours, but articulated business outcomes just too compelling to ignore. You followed your “consensus selling methodology” perfectly, but the competitor boxed you into a corner that you couldn’t even discount your way out of.

Again, consensus selling methodologies help organize all personas you identify. Unfortunately, they don’t teach anticipating and proactively adding new players to an ecosystem. In contrast to methodology, “buyer enablement”: helps customer organizations make better, more well-informed decisions.

Admittedly, expanding the buying ecosystem increases decision complexity. However, don’t make the mistake of thinking that’s always a bad thing. Adding the right people means adding allies…packing the court in your favor.

As I said, I’m marinated in complex selling methodology. It does its job (organizing a given group decision dynamic) really well. For the mission-critical sale, though, today’s methodologies need a specific boost: understanding when, where, and how, and why to change the decision dynamic — and to what.

It’s Not Harder or More Complex. It’s Just Value-Focused

In some ways, value-focused selling is easier. For example, coaching simplifies down to one question “what’s the value?” (OK, sometimes asked over and over like a child asking “why?”) . If your sellers can articulate a complete value picture, they’ve probably performed all of the selling methodology steps just fine. Focusing on value yields a deep understanding of the motivations behind the consensus decision.

- I’ve analyzed and coached perhaps thousands of Miller Heiman Group Blue Sheets. A recurring rep shortcoming is understanding persona-specific Business Results and Personal Wins. Critically, not understanding desired outcomes, and how customers value those outcomes means reps can’t genuinely understand the group decision.

- Similarly, experienced TAS practitioners echo similar deficiencies in users of that methodology. Typically they uncover missing/incomplete Unique Business Value, Critical Success Factors, Compelling Event, and Economic Value Proposition. Again, these are all failures to understand customer value.

I could repeat for other methodologies, but the trend is clear. Salespeople capture groups, but not the value that drives their decision. Worse, they don’t build complete value high and wide in customer organizations.

What if, instead of switching to a new methodology (when the ones out there are fine for organizing a group buying decision)…what if you could just incorporate the missing value conversations into your existing process? Wouldn’t that be a high-value, low interruption, easy-adoption initiative? In fact, this is the elite selling behavior most mission-critical salesforces are missing.

Separately, for those without a methodology in place, what if you start your team at the core of sales–value–then work outward to managing the customer’s decision dynamic as needed? Remember, customer value is what moves all buying decisions — from transactional to mission-critical. Developing your sellers’ “nose for value” is the pivotal skill in any sales environment.

Not All Mission Critical Sellers Act Like It

Earlier, I promised to come back to the words “can/should” in “your offer can affect your customer’s business…”. Here’s the thing: many organizations who sell potentially mission-critical offers don’t sell like their offer is mission-critical. They don’t make it mission-critical for the customer(a la the seller in the lost deal scenario above). Rather, they go through methodology-mandated motions without connecting solution to value, building value, and extending value organization-wide. This leaves deal-winning value – and pricing power – on the table. I’ve managed too many P&Ls to accept this shortcoming.

One of the reasons I focus on the mission-critical sale is that the ROI on “increasing pricing power” is staggeringly high. Notably, this is because pricing dollars are profit dollars. Gaining pricing power is a conversation that CEOs, CROs and COtBs want to have, and I find those conversations a lot more rewarding (OK, valuable) than ones with sales enablement and L&D professionals comparing complex sales methodologies. One sounds more mission-critical than the other, no?

So, want to talk about it? Contact me.

To your success!