Executive Briefings is an online event with a similar kind of context that C-Suite has for physical events. During one of our recent Briefings, Craig Binkley, Chief Executive Officer of Northstar, joined us to discuss how to leverage human insights in a big data world.

As Big Data has changed the way companies think about their base of knowledge of their customers, the importance of understanding the humans behind all those numbers, algorithms and models is becoming even more critical. In this discussion, Craig Binkley, CEO of Northstar, a global insights consultancy, discusses how companies of all kinds must re-commit themselves to better customer understanding as they endeavor to build a more data-driven, customer-centric experience.

When you were a marketing person you were at clearly one of the biggest brands in the world, Coca-Cola. What kind of challenges have you faced when you were doing that kind of job?

Well, interestingly, one of the challenges we used to face was that we didn’t have data. We had to go find new ways to explore it, so it’s funny how this has come around to where there’s so much data now that people can’t actually deal with it.

The challenges were the same in terms of really trying to understand, not only from a positioning and brand-attachment standpoint, how your brand was responding to consumers and vice versa, but also all the different interaction points. Coca-Cola has the benefit of being its own version of a big data universality, because the brands and products are almost everywhere.

We were very much focused on the actual mechanics of consumer movement and behavior, where were they, what were they doing. We didn’t have the kind of data that the people have today. The concepts that we were looking at, interaction points and inflection points and ways that we could use touch points with consumers every day, not only to talk to them but actually try to sell them more product.

Before big data were a lot of the required decisions made from more intuitive perspectives? You had some data but did you have to just trust your gut a bit?

Well, you definitely had to trust your gut. You had to be able to read between the tea leaves. It’s always “How much insight do you have?” and “How much do you need?” based on your risk profile of what the decision’s going to be.

I think that’s a universal thing that’s carried us through. Back in those days, if you didn’t have the information you still had a conceptual idea around test, learn and respond. The more in-tune you were with being able to change your marketing mix and your marketing equation as you read results, that’s what we did then and what were trying to do now.

We’ve been watching big data take the front seat in people’s minds. We’ve come to the conclusion that we can gather all this information about customer behavior, customers’ conversations, customers’ feelings, everything they’ve done with us since they were born. We have all this big data and it is going to give us a clear picture about the customer. Is that true?

What’s happened is that big data has become its own brand. It’s understood many different ways by many different people and that’s become part of the problem. I’ve seen some surveys that talk about how executives define big data and this sort of gives you the sense of the problem we must deal with. It deals with everything from a greater scope of information to new kinds of data and analysis to real-time information to data influx from new technologies to non-traditional forms of media to large volumes of data.

As soon as CEOs are telling you that big data is just one of the latest buzzwords you realize that it’s taken on a life of its own.

CEOs have a different perspective. They have the whole business and they also don’t have the in-depth understanding of the things that we’re going to talk about here because that’s not their job, it’s the CMO or VP of Marketing or the marketing team’s job.

They still walk away with a belief, because of the money we’re spending in this area, big data is going to change their life in some fundamental way. First of all, let’s just agree on what big data is. Big data, to me, is just an awful lot of information. Often it seems to me that if I had more information, I’m on the brink of the potential for chaos.

Absolutely, because any of those little bits of information, if taken as an absolute truth, can lead you down the wrong path. As we talk about going through the looking-glass of big data and what’s behind that, any one of those little things can be just simply a data point, but you don’t understand the things behind it.

It makes it incumbent upon the business people and marketers to take a bit of a deeper look. There’s this idea that you can actually do a little bit of analysis on a lot more data and make better decisions than doing really deep analysis on a little bit of data.

That’s sort of the conundrum that people are in, that big data is creating. Is it walking away from deeper analysis on smaller data, and they’re going into very little analysis on big data.

Is it really key for marketers to understand where the data came from and why is the data the way it is?

Yes. When we get into the marketing component of data, for example, you get all this explosion of data the marketer’s getting. It has a strong bias. What it does is it quantifies behaviors and predicts future outcomes based on historical views.

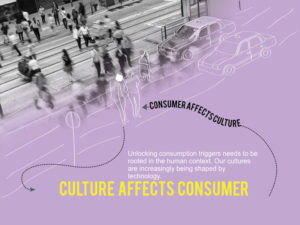

People talk about being predictive and prescriptive and all the words they talk about with data. You can see what customers do and a wide range of activities, but you do not know the why. There’s certainly power in the ability to use that information to adapt your marketing equation to do tests and AB things that help you be more efficient with your marketing impact, but you still don’t understand the “why” behind that.

The humanity of the person behind it is still missing. You can be effective and you can save money and everybody should be thinking about that, but it’s not the complete picture. I have friends that run very large companies that really understand how they need to blend what big data is, what “traditional” market research technologies are and what business strategy understanding is to be able to truly get a complete picture and take the proper actions for sustainable programs and growth.

What I’m intuiting is that what’s missing is a process that’s reason for insights. I can analyze data all day long and I can make my spreadsheets turn out any way I want, but getting the insights from that, that will shape my product development, my programs and more, that’s a different game, isn’t it?

It is a different game and it goes back to the definition that people used to say, “one person’s objective is another person’s strategy.” If your purview is really the number-crunching world and coming up with an anomaly or pattern, this may be considered insight.

From a business standpoint, that’s not really an insight. I think that’s part of the issue we’re driving for here. Just saying, “Here’s a pattern where left-handed people do certain things.” That’s really not an insight. That’s a pattern in the data.

One of the things I’ve seen is that 90 percent of all the data the human race has produced has been in the past two years. With all this data coming in, if we’re simply going to say that an insight is the pattern or the anomaly in the pattern, that’s not enough. As business people and marketers, we can’t just accept that that’s all we need. We need to go deeper than that.

You work with big companies, and they’re grappling with this issue all the time. What are you telling these companies they need to do with this big data so that they, indeed, can get the insights they’re looking for?

There are a couple of things. We’re really talking about a blended viewpoint. That’s sort of the crux of the whole thing because big data can’t do all the pieces for you. You need to be able to blend this together.

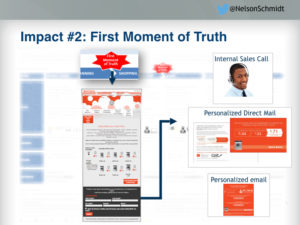

In the big data world, where we have all this information, and it’s not just the social-type information that you know about the likes and the follows and who’s on your page, et cetera. You can actually, then, append in actual purchase data, real purchase data, real response to CRM systems and more things along that line.

Then as researchers, we need to think about is there a cut on the big data before we start doing the survey? Then, if we survey people who we already know things about, we can also take a lot less time getting some of the behavioral understanding that the big data’s already telling us.

We can focus on the acute business issues, the key questions, getting the right insights and direction coming out of that as opposed to spending a lot of survey time trying to get basics that big data, fortunately, already tells us.

Well, it seems to me that big data is a bit like financial reporting. It’s historical but it doesn’t give me an in-depth view of “Why is it the way that it is?”

Yes, we think about the things that combine what big data can’t do. First, it can’t tell you the whys. It cannot effectively tell you the motivations behind actions, the way that traditional methods do. You don’t get the human interaction with it.

It doesn’t tell you about where you don’t have the data. For example, if you’re a retailer and you’re looking at a $1,000 customer and all your data in your dataset tells you a $1,000 customer is a very good customer, but you don’t know the denominator. You don’t know whether that’s $1,000 or more than $1,0000 or less than $1,000 or out of $10,000.

You need to use new tools to go beyond that, to figure out what the headspace or the growth opportunity is for your customer base. You can’t just be within your own limits of your own data.

It also can’t measure what doesn’t exist. We do a lot of work for major companies on new product development and there’s absolutely no way that big data can tell you about a completely new idea. Logically, we know that it can’t do that.

Another part of big data that’s interesting is that so much of the conversation is around technology. It gets into processing powers, storage technology, building algorithms and what technology you need to buy. It’s not seen as what it really can be, which is rapid experimentation, smarter decisions and predictive insights. The technology component of big data, to some extent, still dominates the conversation versus the consumer and customer part of it.

Lastly, the blending allows qualitative research to build customer relationships. If companies think about the “research component” of their CRM and their connection into all these touch points as part of a relationship, now you’re talking.

Now you’re talking about a direct customer relationship that blends the best of what big data tells you, the best of what you can do programmatically to effect your marketing equation and the best of what you can do to particularly survey and get human insights behind that.

As soon as we start looking at that model, we’re starting to hit all the right buttons for what we can really do as marketers and business people to leverage big data, leverage traditional tools, leverage and get true insights that will drive strategy.

It seems to me that there is a disconnect because the data analyzers have a different skill set than the data interpreters. Do we need to create a different kind of role in organizations that sits at the center of big data to bring a bigger skill set to apply to this?

That’s a very interesting point. The answer is yes. They are different. Even in our own organization, we have a lot of studies that we do for customers that are more of what you would call the big-data type. They’re highly numeric and they’re less of the intuitive — certainly qualitative versus quantitative.

Even our own people are a blend of skills, and we put those together on teams to bring the best solution to the clients. On the clients’ side that same thing is happening. Big data research is really the art and science of combining what is behavioral data, attitudinal data and the analytics that you get, so that you can get better business results.

That, like a lot of things in companies, requires a different set of skills to come together behind a common mission and be able to work together, to communicate together, which is why I think it’s so important that this conversation happen at a high enough level. This way it can combine those different skills and not be taken down one path of a very easy, lazy conversation around “big data” because it’s so misunderstood.

Is there any data showing the impact of all this data on the top and bottom lines of companies?

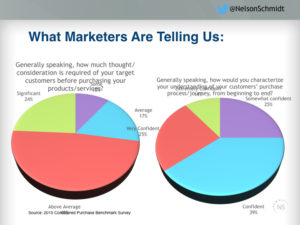

I haven’t seen that. What I do know is that only 15 percent of CMOs have been able to quantify the impact of social media on their business. When we see numbers like that with the social media component, that is what drives a lot of this.

It’s because we had the Facebooks and the Googles and all these people collecting all this data and tracking everything — the time you tried to buy that ugly tie and it chased you across the Internet. That pretty much shows you that that’s what’s happening.

It’s going to get even bigger with the Internet of Things. All of a sudden, your world gets surrounded by the data that gets to you. The more this happens, you notice that if 15 percent of CMOs have been able to quantify the impact, that means 85 percent haven’t, and that’s just social media.

Then, start to think about the other components of data and programmatic buying and more. You know that the old adage of “50 percent of my marketing is wasted, I just don’t know which 50 percent.” You know that’s still true in this world.

Is marketing just a murky area?

Absolutely. I mean, can you imagine going to a cocktail party and leading a brand and not having a social presence? Your people would beat you up, or you’d be the uncoolest person at the party.

There is a role for all these new technologies. I’d look back in time and we used to have a dream, a vision, that when someone was going down the aisle that if only you could simply spring-load an orange juice can, this was back in the days of frozen orange juice, into your customer’s cart when you knew they showed up.

Then today, the reality is with beacons and mobile devices, you’re pretty close to that. There are clearly all these opportunities, from a marketing standpoint, where you can really have interactions that are correct with your customer. You can understand and do programmatic if-then and games and engagement rules to where you can actually really have a much better, more appropriate relationship with your customer.

That’s all great, but if you don’t really understand the pieces of the data that gets created, you’re simply working in the if-then. Again, part of the problem, in the long term, is that if you follow the programmatic big data and you effect the marketing equation today, you will have success. If you do it well you will have success. Whether that’s three percent, five percent, eight percent, you will get better.

I think that if people are just simply happy to get that three or five or eight percent, they’re missing a much bigger opportunity to blend it together and shoot for that 15, 20 percent improvement that you can get if you really understand why those beacon touch points and why those ATM touch points and all the CRM stuff that you’re kicking out with the data, why that’s happening the way it is. That’s where the strategy has to happen. It can’t happen simply tactically; it’s got to happen strategically.

I can really understand how this all applies in what we would call the B2C world, but what role does this play in the B2B world?

Interestingly, in the B2B world, B2B companies a long time ago were out in front of CRM. They actually used to have more data on a customer than a typical consumer products company did. The problem was a lot of that data was at an enterprise level as opposed to a human level and so the similar part about understanding the human behind the numbers.

We’ve done a lot of work over the years in B2B, helping companies understand that. If you want to sell a market into a B2B environment, you have to actually understand that there is a human that’s in that job position that’s inside of that company you’re trying to sell to, which is a rooftop customer, an enterprise customer.

The human insights behind that become the same. You’ve got to understand the humanity behind this. Whether it’s B2B or B2C, it’s understanding humans because even in a B2B buying environment, when you’re marketing and selling, whether it’s $100,000,000 technology deals or it’s a smaller scale, you have to understand the humanity behind that.

If all the CRM systems in B2B are just kicking out numbers and numbers and numbers, you really can’t effectively do any marketing and selling program inside of that.

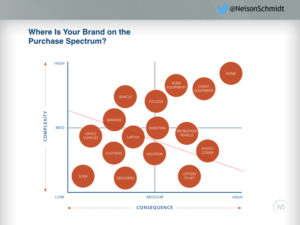

When I think about considered purchase, it would seem to me to be more difficult for us to use big data unless we have some interpretation of it because considered purchase is really that. My consideration for buying something, particularly bigger-ticket items has to do with so many different variables that it’d be a bit harder to predict that, wouldn’t it?

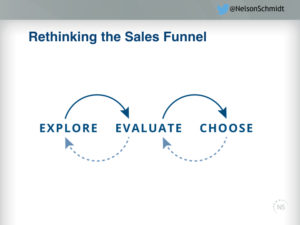

I think that’s a very good point, because the humanity behind a considered purchase in both worlds requires you to get the humanity. What the programmatic stuff does, whether it’s messaging or it’s advertising or touch point or force outs or promotions, is in fact doing much more of this sort of impulse move that says somebody is in a mindset but you’re actually trying to get them to just move to the next level. That next level of purchase or the next logical product that you get out of big data.

In a B2B environment you’ve got a much different sort of consideration set. You’ve got multiple constituencies that go into it, and I do think that it even calls more for the human component as opposed to letting the big data drive the engine.

Do you foresee big data insights ultimately being generated programmatically? Will the model be sophisticated enough that we can now move a step back and say, “Now, we don’t need so much of the intuition” and “We need something that’s more consistent because human intuition is a little flawed”?

Human intuition is always going to be flawed and A.I. (artificial intelligence) is going to take over a component. What will happen is that level of “insight” that comes out of the data will get better and better through A.I. and learning. That’s the dynamic of A.I., the intelligence and how it gets smarter at what it does, but it still doesn’t give you the human behind it.

There’s a piece of this which is always going to be that we need to actually talk to the people that are generating all that data. We need to get inside the head. We need to understand why things happen. We need to be able to both append and amend what we’re learning from the big data with other types of information.

I don’t think it’s ever going to be totally programmatic, but, certainly, we would expect that the nature of big data is the more you collect, the better the models become, right? The more data points you have. It will get better. It will be programmed to be better but it’s not going to — we have to talk to humans. We can’t leave the humans behind.

It seems to me, from what you’re saying, that if we can automate more of it, then that leaves more of our budget available to actually spend time talking to the customer. Then bringing those two together to create the right perspectives.

That’s true everywhere. What’s happening is that because we have all this data on customers, we don’t have to spend the time. We can focus more on what the real need for information is from them, so we don’t waste their time, because we have survey burnout. People don’t want to do them. They don’t want to take a long time, so because of numbers, we can use a lot more people, split the questionnaires up and actually get a lot more information at the acute human level than we could get before.

The other thing is the platforms that are allowing us, as researchers, to more efficiently take that data and put it into more visual information. Taking out some of the human component of the research process itself is making it much more efficient.

We are now polling like crazy, particularly in the political arena, right? There’s a poll every five minutes. Is this polling of people sort of corrupting the validity of polling? The data changes so often that it’s hard to see what’s really going on.

There are actually some articles on polling. We have a company inside of our MDC partners’ network that really is deeply into the political world and polling. The problem is, there’s the traditional research of statistical significance and probabilities and a lot of big number. In a lot of cases, when people are voting it’s binary. It’s either I’m voting this or that.

Polling has, as we’ve seen in many elections around the world over the past seven or eight years particularly. It has that dimension that says, “Well, the probability is 98 percent.” If the two percent happens, everybody looks a little bit silly. I think that has actually happened to polling and it has hurt the idea of what polling does.

That’s sort of an unfair attack on the total value of polling when what we’re talking about is not polling to figure out what it is you’re going to vote for or not, but actually trying to get some human insight behind the poll to drive the strategy.

I think it is like the polling argues the same thing we’re talking about with big data. It’s not enough. You need to go behind that a little further.

How does that perception of polling not being as accurate as, perhaps, people thought it was once? How does that impact companies you work with looking to you to do research? Does it impact their mindset?

It does, and that’s why I come back to the blended discussion. If we say we’re going to talk to 1,500 people that we get from a panel, who claim they’ve bought a fashion brand. They promise you that they’ve bought it in the last 60 days, and they’re quite sure that they paid more than $200 for that. That’s all respondent-based claimed behavior.

In today’s world that same company has a list of 500,000 customers. They know what they bought. They know where they bought it. They know what size, how often and what marketing they responded to. As researchers, we need to change our model and not rely on panels of claimed behavior but actually integrate with the actual customer database that our clients had.

We’re doing that more and more and more. Clients are coming to us and saying, “You’re doing our net promoter’s score, talking about satisfaction and promoting our brand. We have this great promoter trend over time. Let’s start tacking it onto the data we have on our campaigns and our users and our profitability to make it a more robust view.”

From both sides, we’re getting this idea that we need to bring it together and create a more robust blending of insights behind the data that’s being captured on all our customers with all the technologies and the CRM systems and the socials, and match that up to this more acute learning that we’re doing. Without that, either side is going to be incomplete.

Thomas White is the CEO of The C-Suite Network and the host of the nationally syndicated video program, Business Matters. This was taken from dialogue on C-Suite Executive Briefings.