Fractional CFO Services

Fractional CFO (Chief Financial Officer) Services

A Fractional CFO (Chief Financial Officer) is a financial professional who provides part-time or on-demand CFO services to businesses, typically on a contract basis. Fractional CFOs offer the expertise and strategic financial guidance of a traditional CFO but work for multiple clients simultaneously, allowing smaller or emerging companies to access high-level financial expertise without the cost of a full-time executive. Here’s when you should consider hiring a Fractional CFO for your startup or emerging company: (You will need someone to help you calculate your value)

1. Limited Financial Expertise: If you or your team lack in-depth financial knowledge and experience, a Fractional CFO can provide guidance on financial strategy, budgeting, forecasting, capital raises and financial reporting.

2. Financial Complexity: As your business grows, financial complexity increases. If you’re dealing with multiple revenue streams, investments, debt, or complex financial structures, a Fractional CFO can help manage these intricacies.

3. Fundraising: If you’re planning to raise capital through venture capital, angel investors, or loans, a Fractional CFO can assist in preparing financial projections, financial models, and investor communications.

4. Cost Management: Fractional CFOs can help identify cost-saving opportunities and streamline financial processes to improve efficiency.

5. Strategic Planning: They can assist in developing and executing a financial strategy that aligns with your business goals and objectives.

6. Cash Flow Management: Effective cash flow management is critical for startups. A Fractional CFO can help monitor and manage cash flow to ensure the business has enough liquidity to operate smoothly.

7. Risk Management: Identifying and mitigating financial risks is essential. A Fractional CFO can assess financial risks and implement strategies to reduce exposure.

8. Financial Reporting: They can prepare accurate financial statements and reports for internal use and external stakeholders, such as investors or creditors.

9. Exit Planning: If you have plans for an exit strategy, such as selling the company or going public, a Fractional CFO can help prepare for this significant financial event.

10. Cost-Effective Solution: For many startups and emerging companies, hiring a full-time CFO may not be financially feasible. Fractional CFOs offer a cost-effective alternative, providing high-level financial expertise without the full-time salary and benefits.

11. Scalability: As your business grows, you can adjust the level of fractional CFO support to meet your changing needs. This scalability is especially valuable for startups experiencing rapid growth.

12. Short-Term Projects: If you have specific financial projects or initiatives that require specialized expertise, a Fractional CFO can be hired for a short-term engagement.

When considering hiring a Fractional CFO, it’s important to evaluate your company’s specific financial needs, budget, and growth trajectory. Fractional CFOs can offer tailored solutions to help startups and emerging companies navigate financial challenges and achieve their strategic objectives.

Fractional CFO Interview Checklist

| Category | Questions and Considerations |

|---|---|

| Qualifications and Experience | – Educational background and qualifications – Years of CFO or senior financial experience – Past experience with startups or emerging companies |

| Industry Expertise | – Familiarity with your industry or related industries – Insights on industry-specific financial challenges or opportunities |

| Services Offered | – Specific financial services provided as a Fractional CFO – Areas of financial expertise or specialization |

| Availability and Commitment | – Weekly or monthly availability – Concurrent clients and time management strategies |

| Track Record | – References or case studies from previous clients – Notable achievements or results for other companies |

| Approach to Financial Strategy | – Methods for financial strategy and planning – Approach to financial forecasting and budgeting |

| Risk Management | – Assessment and mitigation of financial risks – Examples of effective risk management for clients |

| Reporting and Communication | – Communication with non-financial stakeholders – Tools or software for financial reporting and analysis |

| Cost Structure | – Fee structure for Fractional CFO services – Additional costs or expenses to be aware of |

| Growth Strategy | – Assistance in achieving financial growth and scalability – Insights on funding, mergers, acquisitions, or exits (if applicable) |

| Problem-Solving Skills | – Examples of complex financial problem-solving for clients – Approach to resolving financial challenges |

| Cultural Fit | – Collaboration with team members and departments – Alignment of financial goals with company culture and values |

| Confidentiality | – Measures to ensure confidentiality and security of financial information |

| Communication and Updates | – Frequency of financial updates and progress reports – Contact information for urgent financial matters |

| Exit Strategy | – Plan for transitioning out of the engagement when it concludes |

| Contract and Terms | – Terms of the contract or engagement agreement – Termination clauses or notice periods |

This checklist can help you thoroughly assess a Fractional CFO candidate and determine if they are the right fit for your startup or emerging company’s financial needs and goals.

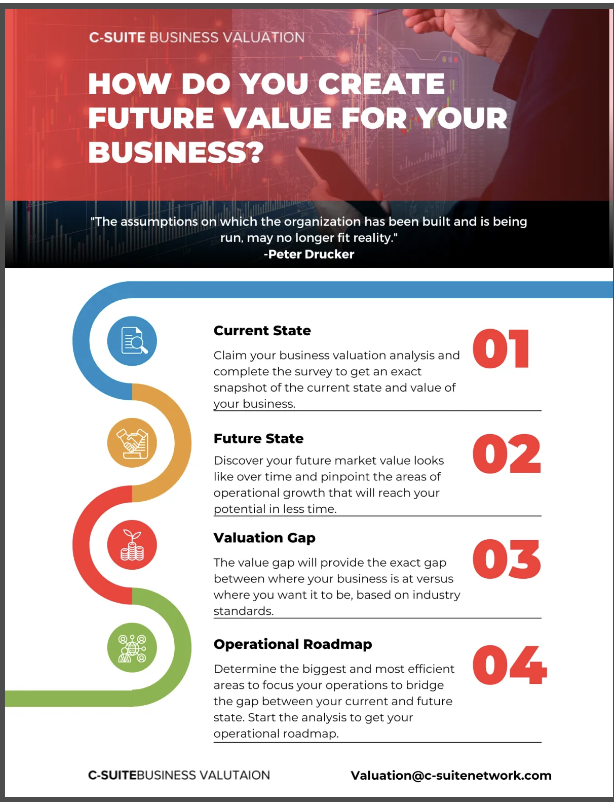

Fractional CFO Services can also provide Business Valuation Gap Analysis

Fractional CFO Services can also provide Business Valuation Gap Analysis

- My Funded Futures - April 16, 2024

- Day Trading Books - April 3, 2024

- Four common types of changes and trends that can offer Business Opportunities? - March 24, 2024