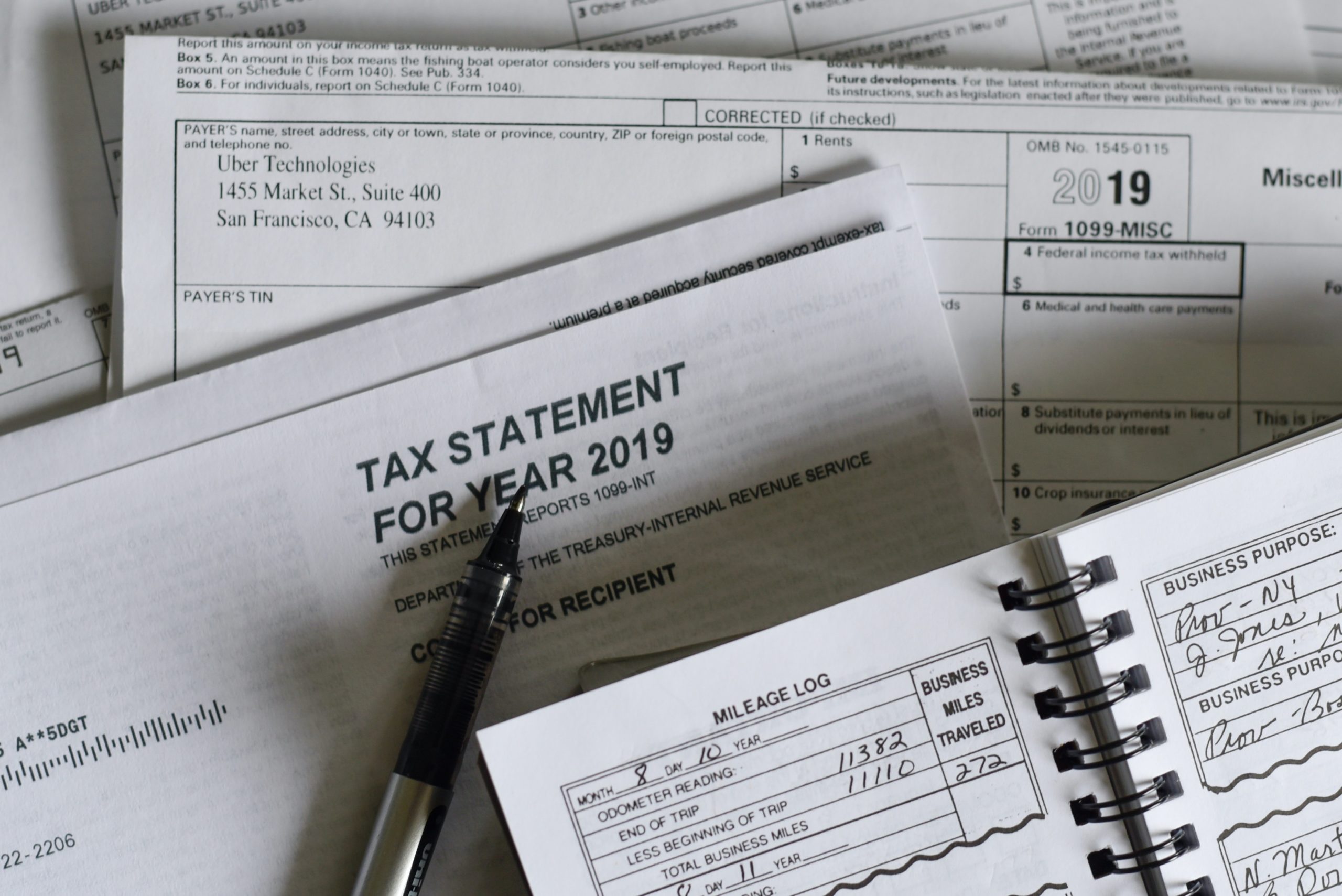

Travel and Entertainment Business Expense Deduction Summary

The 2017 Tax Cuts and Jobs Act made some major modifications to the travel, entertainment, taxable fringe benefits and moving expense deductibility for taxpayers. Above is a summary that shows the difference in the current deductibility (or inclusion in income for employees) for certain of these deductions.

At GROCO, we assist high net worth clients and their families with wealth creation, family transfers, taxes and charitable giving. Please give me a call at 510-797-8661 if you need assistance or have questions on these new rules or would like to know how to make, keep and/or transfer your wealth.

Steven Singer is a partner at Greenstein, Rogoff, Olsen & Co., LLP (GROCO). An internationally recognized premier accounting firm. Serving the venture capital (VC), private equity, family office and ultra-high net worth communities, Steve’s specialty is guiding entrepreneurs and their families thru liquidity events, succession planning and a variety of Corporate and family issues. Companies his clients have helped grow: Tesla, Space X, Box & Google, just to name a few.

As an author, advisor and CFO to numerous high tech, real estate and companies in a variety of industries, Steve’s unique perspective gives insight into both exponential growth and tax strategies.

Currently serving as advisor or board member to several national and international organizations. Steve holds a B.S. degree in Business from U.C. Berkeley and Master degree in taxation from Golden Gate University.|Steven Singer is a partner at Greenstein, Rogoff, Olsen & Co., LLP (GROCO). An internationally recognized premier accounting firm. Serving the venture capital (VC), private equity, family office and ultra-high net worth communities, Steve’s specialty is guiding entrepreneurs and their families thru liquidity events, succession planning and a variety of Corporate and family issues. Companies his clients have helped grow: Tesla, Space X, Box & Google, just to name a few.

As an author, advisor and CFO to numerous high tech, real estate and companies in a variety of industries, Steve’s unique perspective gives insight into both exponential growth and tax strategies.

Currently serving as advisor or board member to several national and international organizations. Steve holds a B.S. degree in Business from U.C. Berkeley and Master degree in taxation from Golden Gate University.|Steven Singer is a partner at Greenstein, Rogoff, Olsen & Co., LLP (GROCO). An internationally recognized premier accounting firm. Serving the venture capital (VC), private equity, family office and ultra-high net worth communities, Steve’s specialty is guiding entrepreneurs and their families thru liquidity events, succession planning and a variety of Corporate and family issues. Companies his clients have helped grow: Tesla, Space X, Box & Google, just to name a few.

As an author, advisor and CFO to numerous high tech, real estate and companies in a variety of industries, Steve’s unique perspective gives insight into both exponential growth and tax strategies.

Currently serving as advisor or board member to several national and international organizations. Steve holds a B.S. degree in Business from U.C. Berkeley and Master degree in taxation from Golden Gate University.

As an author, advisor and CFO to numerous high tech, real estate and companies in a variety of industries, Steve’s unique perspective gives insight into both exponential growth and tax strategies.

Currently serving as advisor or board member to several national and international organizations. Steve holds a B.S. degree in Business from U.C. Berkeley and Master degree in taxation from Golden Gate University.|Steven Singer is a partner at Greenstein, Rogoff, Olsen & Co., LLP (GROCO). An internationally recognized premier accounting firm. Serving the venture capital (VC), private equity, family office and ultra-high net worth communities, Steve’s specialty is guiding entrepreneurs and their families thru liquidity events, succession planning and a variety of Corporate and family issues. Companies his clients have helped grow: Tesla, Space X, Box & Google, just to name a few.

As an author, advisor and CFO to numerous high tech, real estate and companies in a variety of industries, Steve’s unique perspective gives insight into both exponential growth and tax strategies.

Currently serving as advisor or board member to several national and international organizations. Steve holds a B.S. degree in Business from U.C. Berkeley and Master degree in taxation from Golden Gate University.|Steven Singer is a partner at Greenstein, Rogoff, Olsen & Co., LLP (GROCO). An internationally recognized premier accounting firm. Serving the venture capital (VC), private equity, family office and ultra-high net worth communities, Steve’s specialty is guiding entrepreneurs and their families thru liquidity events, succession planning and a variety of Corporate and family issues. Companies his clients have helped grow: Tesla, Space X, Box & Google, just to name a few.

As an author, advisor and CFO to numerous high tech, real estate and companies in a variety of industries, Steve’s unique perspective gives insight into both exponential growth and tax strategies.

Currently serving as advisor or board member to several national and international organizations. Steve holds a B.S. degree in Business from U.C. Berkeley and Master degree in taxation from Golden Gate University.

Latest posts by Steven Singer (see all)

- Travel and Entertainment Business Expense Deduction Summary - March 9, 2018

- Highlights of the 2017 Tax Cuts & Jobs Act - March 2, 2018

- Maximizing the Value of Your Carried Interest - February 20, 2018